Evgenii Mitroshin

VOC Energy Trust (NYSE: VOC) (the “Trust”) was incorporated as a statutory trust in November 2010 by VOC Brazos Energy Partners, LP According to Form 10-K:

The underlying properties consist of net interests of VOC Brazos in substantially all of its oil assets and the natural gas properties net of all related royalties and other production charges as of May 10, 2011, which properties are located in the states of Kansas and Texas. VOC operators are currently the operators or contract operators of almost all of the underlying properties. »

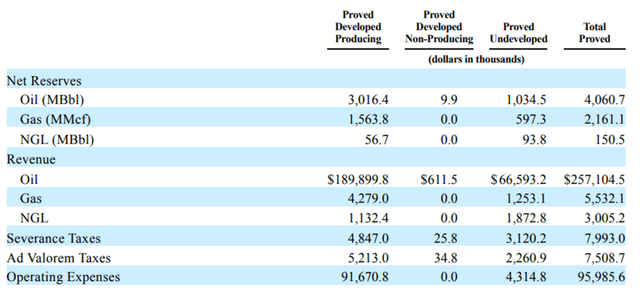

As of December 31, 2021, the total proved reserves of the underlying properties and the forecast for the remaining term of the trust are as follows:

VOC

Remarks:

1. Oil and gas prices have been adjusted to a WTI Cushing oil price of $66.56 per barrel and a Henry Hub natural gas price of $3.598 per MMBtu.

2. As specified by the SEC, these prices are 12-month averages based on the price on the first day of each month in 2021. Price adjustments were based on forecast oil price deviations at -$4.50 per barrel for the underlying Kansas properties, −$2.00 per barrel for the Kurten (Woodbine) Field wells in Texas, −$3.75 per barrel for the Sand Flat Unit and Hitts Lake North Field wells in Texas and −$2.00 per barrel for all other underlying Texas properties.

Sales and costs for the three years ending in 2021 show that oil accounts for the vast majority of revenue, making it “pure play” in crude oil price exposure.

Performance

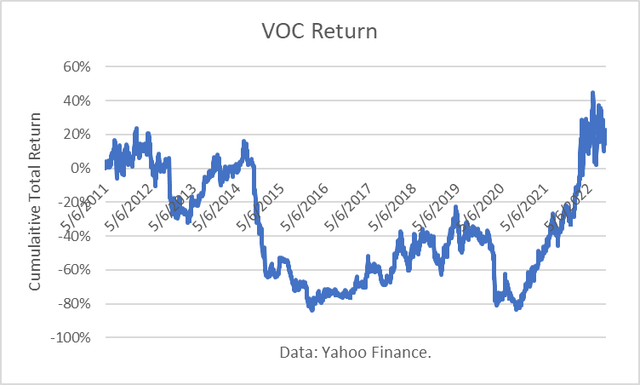

Since its inception on May 6, 2011, VOC has had a total return of 14.5%, even with the surge in crude oil prices in 2022.

Yahoo finance

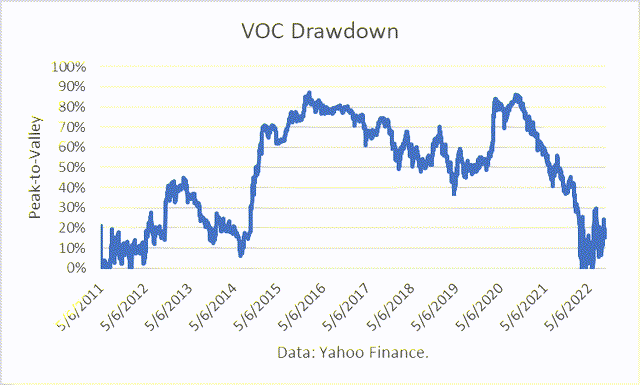

The maximum drawdown (“MD”) over the period was 87%, reached on September 9, 2020. I consider the MD to be the primary measure of risk, as it quantifies how much an investor could have lost from their peak. Investors often exit positions when losses exceed risk tolerances, thereby locking in the loss.

A DM of 87% implies that the product is not suitable as a long-term investment. And its long-term total return pales in comparison to that of the broader stock market, as shown below.

Yahoo Finance, BRS

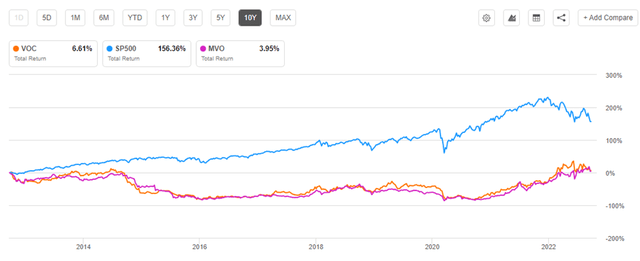

Over the past ten years, VOC has had a total return of only 6.6%. This compares to the S&P (SP500TR) return of 156.4%.

MV Oil Trust (MVO) and VOC are both limited trusts operated by Vess Oil. Its return has therefore been very similar, totaling +4.0% over the last ten years.

Looking for Alpha

As I previously explained in another post, I started trading in a futures market account on June 23rd. I have had many other oil futures trading accounts since 1980 when I started trading NYMEX (“HO”) heating oil.

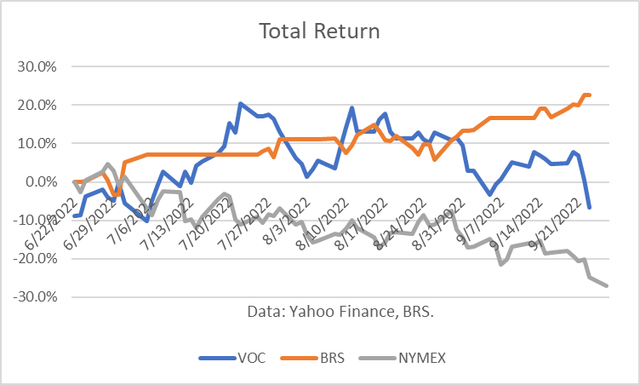

The market has been very volatile and difficult. I made a profit of 22.6% through September 26, versus a NYMEX (“NYMEX”) crude oil futures price loss of about 27% and a VOC loss of about 7%.

Yahoo Finance, BRS

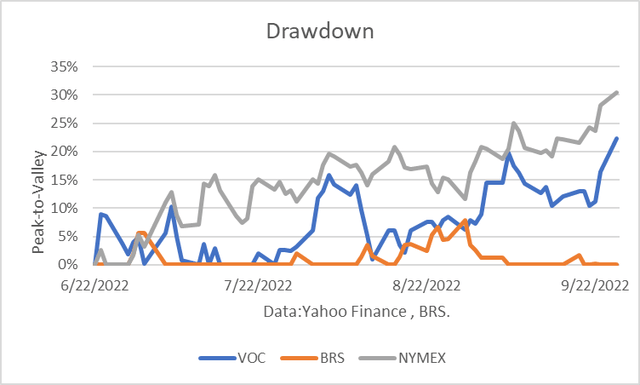

The maximum drawdown from the BRS crude oil account was 8%, compared to 30% for NYMEX and 22% for VOC.

Yahoo Finance, BRS

Market Fundamentals

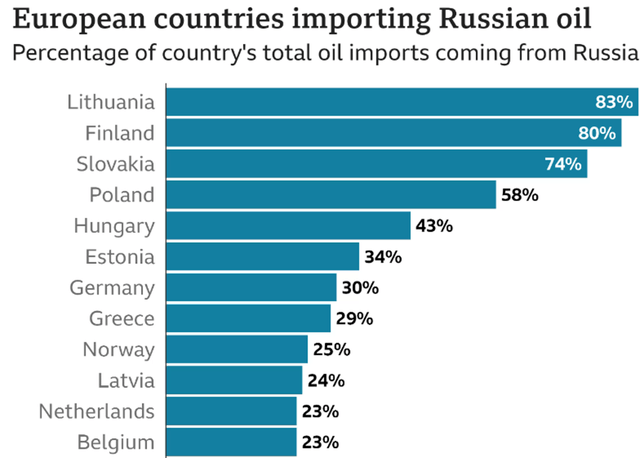

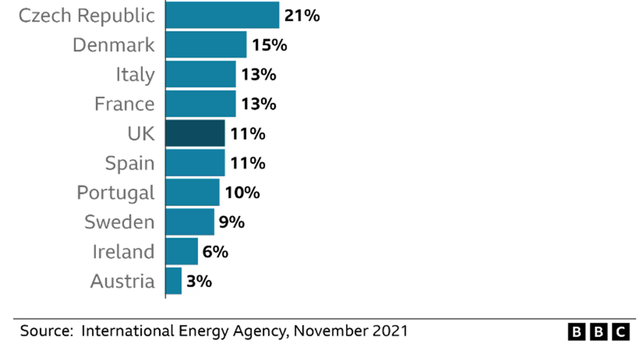

The major story in 2022 so far this year, and dating back to the OPDEC oil embargo in 1973-74, is Russia’s February 2022 invasion of Ukraine and oil sanctions and bans resulting Russian Federation and its disruption of pipeline shipments to Europe. . The EU has agreed to ban all Russian oil imports arriving by sea by the end of this year.

OUCH

OUCH

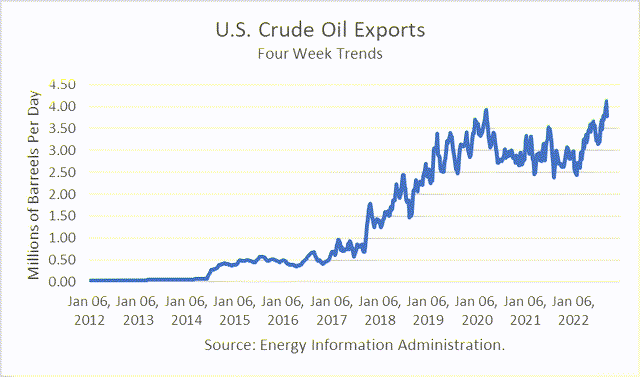

The US replaced about half of the 800,000 b/d of Russian oil imports to the EU, as US crude oil exports hit record highs.

EIA

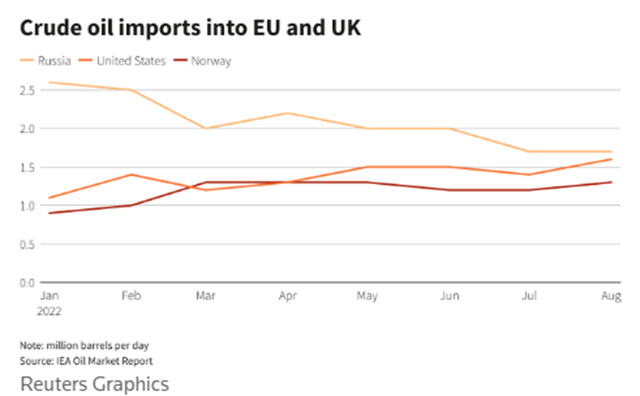

The United States may soon overtake Russian imports of crude oil to the EU and the United Kingdom. Norway replaced about a third of Russian imports.

OUCH

Source: Reuters.

The IEA estimated that:

“The EU will need to replace an additional 1.4 million barrels of Russian crude, including some 300,000 bpd potentially from the United States and 400,000 bpd from Kazakhstan.”

In order to retain its oil revenues, Russia has increased its exports to China, India and Turkey.

Norway is expected to increase its North Sea production in the fourth quarter, and exports from the Middle East and Latin America that were going to China and India could be redirected to the EU.

It has been reported that “Europe has reduced its consumption of Russian gas from 40% to less than 10%. And his reserve goals for the winter are almost full.

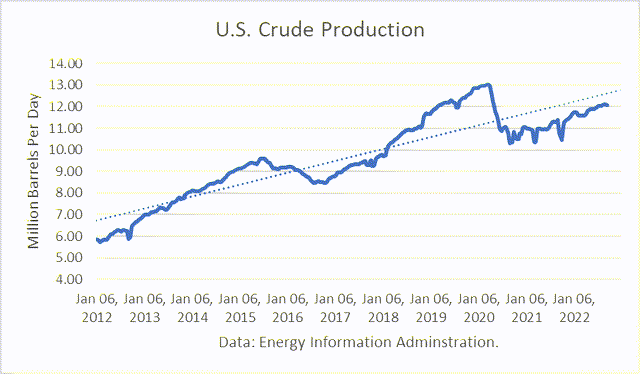

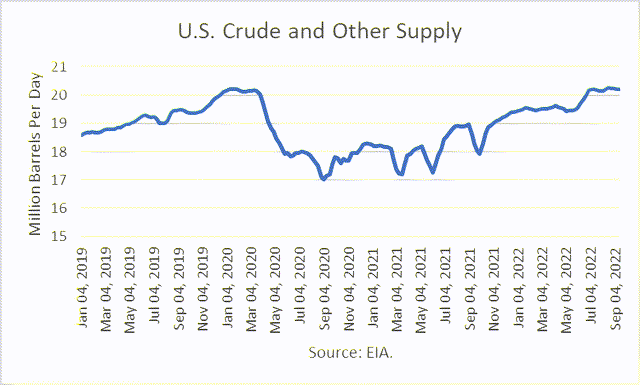

US crude oil production was disrupted due to the sharp drop in oil prices in 2020 when Saudi Arabia and Russia waged an oil price war.

EIA

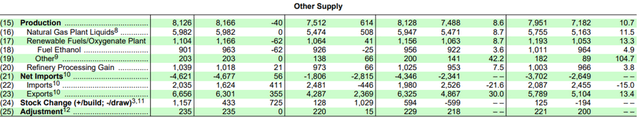

However, “other supplies,” such as natural gas plant liquids and renewable fuels, also contribute to the United States’ oil supply.

EIA

In total, US oil supplies recently hit a new record high. This fact is rarely reported.

EIA

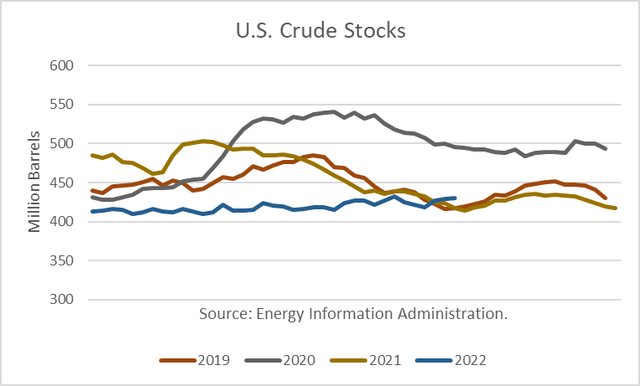

With the addition of crude oil withdrawals from the U.S. Strategic Petroleum Reserve (“SPR”), commercially available crude oil inventories now exceed 2019 and 2021 levels. And the DOE recently announced:

“a notice of sale of up to 10 million barrels of crude oil to be delivered from the Strategic Petroleum Reserve in November 2022. This notice of sale is part of President Biden’s March 31, 2022 announcement authorizing the sale of SPR crude oil as ongoing support to help deal with the significant market supply disruption caused by Putin’s war on Ukraine and help reduce energy costs for American families .

EIA

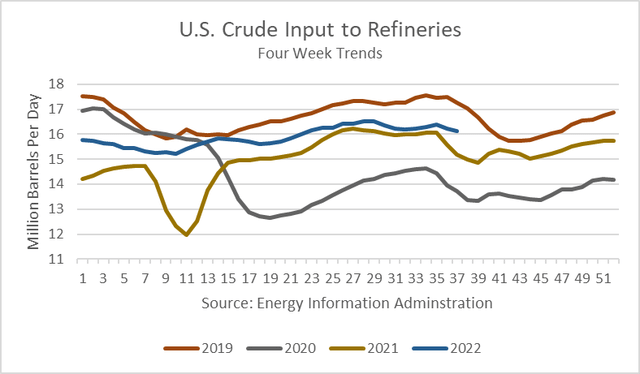

US refiners have increased their production of petroleum products compared to 2020 and 2021.

EIA

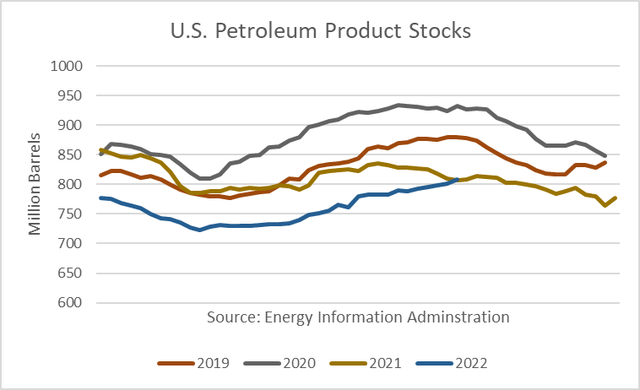

This contributed to the recovery of petroleum product inventories.

EIA

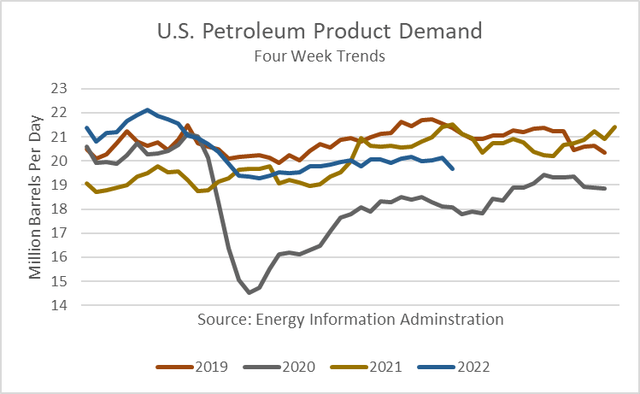

However, high retail oil prices have also resulted in lower demand for petroleum products.

EIA

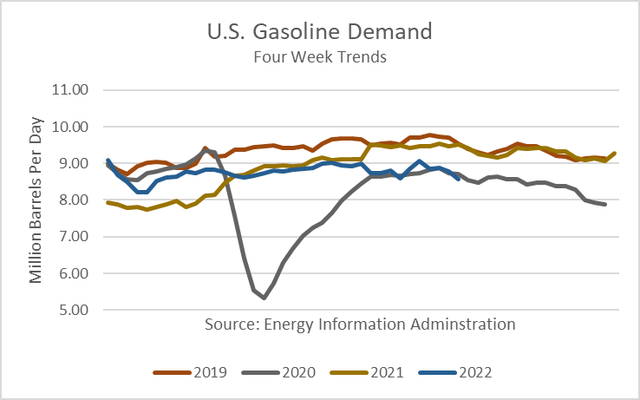

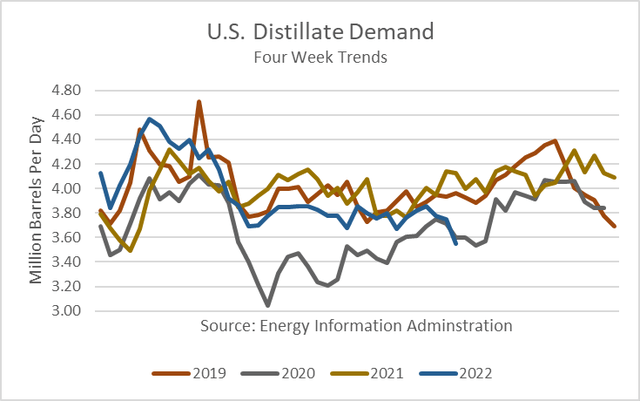

Demand for gasoline and distillates has fallen to pandemic 2020 levels for this time of year.

EIA

EIA

conclusion

VOC is an energy trust that is almost entirely exposed to crude oil prices. For investors who want this exposure without trading an account in the oil futures market, this is a suitable alternative. However, as stated above, it is not a suitable long term investment as it has performed too little and has been subject to an excessively large decline.

The oil market has changed since Russia invaded Ukraine in February. High oil and natural gas prices, particularly in Europe, have created major risks of economic recession. And the most recent interest rate hikes to fight inflation add to the risks. As a result, demand for oil fell and inventories adjusted along with trade flows.

I changed my futures trading to be a “short” seller. My results have been profitable, especially compared to passive long positions in crude and VOC futures. I provide my positioning and my journey in my Finding the Alpha Marketplace service, Boslego Risk Services.