U.S. stocks could lag their European counterparts even as the dollar strengthens against the euro and growth and inflation trends diverge, pushing the Fed and ECB in opposite directions.

-

U.S. GDP data offers fuzzy signals on economic growth and inflation trends.

-

New US PCE inflation data is unlikely to change much due to Fed rate cuts.

-

Stocks and currencies in Europe and the United States could be about to diverge.

Markets struggled to know what to make of the first quarter US gross domestic product (GDP) data.

Overall, output growth clocked in at a paltry 1.6% annualized rate, well below analysts’ baseline forecast of 2.5% and even the Federal Reserve’s most pessimistic model, which predicted 1.7%. % before publication. At the same time, the core inflation component jumped to 3.7% from 2.0% in the previous quarter.

US GDP data: mixed signals?

A look beneath the surface seems to reconcile these disparate findings. Consumption, the main driver of economic growth, has slowed somewhat, but nevertheless appears solid overall. The main downdraft came from the outer side of the equation. Trade subtracted 0.86 percentage points from overall growth due to the sharp rise in imports.

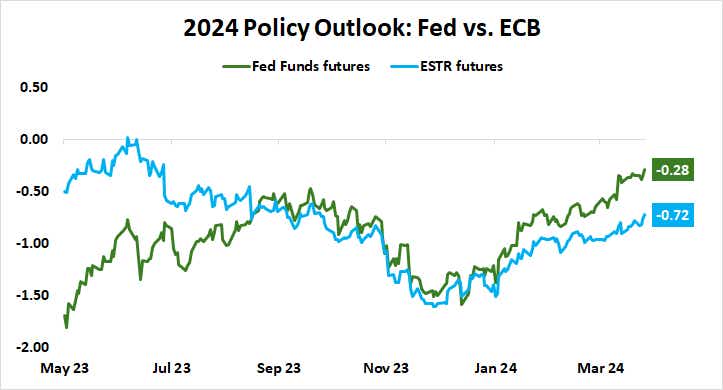

Stocks fell and Treasury yields rose when the data was released as strong price growth pushed the Federal Reserve to cut its interest rate expectations in a hawkish direction. Fed funds futures now price in just 29 basis points (bps) of easing for 2024, implying a standard 25 bps cut and a measly 16% chance of getting a second one.

Wall Street, however, was quick to recover. The flagship S&P 500 stock index began to recover within two hours of the data being released. In five hours, the GDP-induced losses were erased. The intraday seesaw now puts stocks on track to end the session unchanged.

US PCE data: inflation returns to center stage

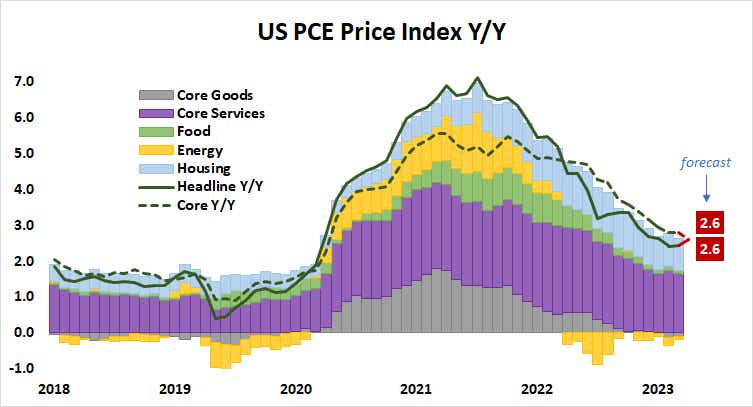

From there, the March edition of the Fed’s preferred measure of personal consumption expenditures (PCE) inflation rounds out the week of economic data releases. Overall price growth is expected to reach 2.6% year-on-year, up from 2.5% in February. The base rate excluding volatile food products and energy is also forecast at 2.6%, compared to 2.8% previously.

The PCE measure can be calculated with relative accuracy after taking into account the Consumer and Producer Price Index (CPI and PPI) figures for the same period, such that a significant deviation from the Median projections seem unlikely. In the absence of a striking gap and with a Fed rate decision expected on May 1, markets may choose to ignore this release.

Europe and the United States diverge on growth and prices

Overall, the main takeaway from this week’s news seems to be the growing disparity between the United States and Europe. Purchasing Managers’ Index (PMI) data released earlier this week revealed slowing dynamics in the former – an assessment largely supported by GDP results – and a firmer recovery in the latter.

At the same time, the inflation picture diverges in the opposite direction. Eurozone Consumer Price Index (CPI) data, due next week, is expected to put price growth at 2.4% year-on-year in April, matching a four-month low reached in March. This contrasts sharply with the attractive price statements displayed across the Atlantic.

Overall, this has led to a yawning gap in monetary policy expectations. The European Central Bank is expected to make three rate cuts compared to just one for the Fed. This appears to create a favorable backdrop for the US dollar, but Wall Street could find itself lagging stock prices on the continent (ETF: EZU).

Ilya Spivak, tastylive, Head of Global Macro, has 15 years of trading strategy experience and specializes in identifying thematic movements in currencies, commodities, interest rates and stocks. It hosts Macro money and co-hosts Over time, Monday Thursday. @Ilyaspivak

For daily live programming, market news and commentaryvisit tastylive or YouTube channels tastylive (for options traders), and tastyliveTrends for stocks, futures, forex and macro.

Trade with a better broker, open a tasty account Today. savorylive, Inc. and savorytrade, Inc. are separate but affiliated companies.