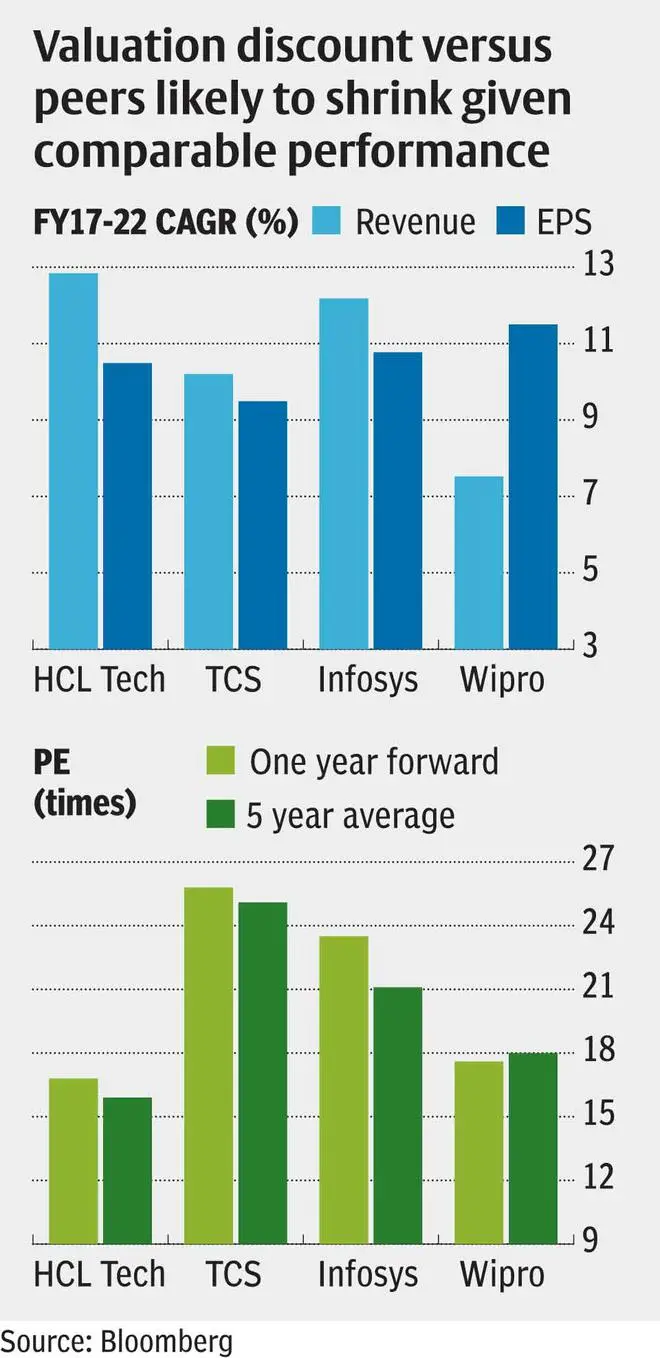

Last year, in our BL Portfolio edition of June 6, we recommended suspendingHCL Technologies for long-term investors when the stock was trading at ₹937. While we were cautious on the IT sector in general due to stretched valuations, we had a relatively positive view on HCL Technologies (HCL) given its performance comparable to that of other Tier 1 peers (TCS, Infosys and Wipro), yet trading at a discounted valuation. This offered a relatively better margin of safety compared to peers.

While the stock currently trades at ₹924.85 including dividends, it has returned around 5% over this period, slightly outperforming the Nifty IT Index. With the headwind of economic slowdown in key geographies from which Indian IT derives most of its revenue (US and Europe), driven by hawkish central banks and the impact of geopolitical issues (energy crisis in Europe) , the risk-reward ratio remains unfavorable for most companies in the Indian IT space at current valuations. However, HCL Technologies, which trades at a one-year forward PE of 16.9x, an EV/FCF of around 19x and a dividend yield of 5% (the best among its peers), appears to be a outlier in this regard and continues to offer better margins of safety compared to other companies in the industry.

We now recommend long-term investors to accumulate the stock on the dips. Given its position as one of the world’s leading IT services companies and its well-established track record, its valuations are not expensive on an absolute level and its dividend yield is attractive. It also has an entrenched position and scale of operations to capitalize on the multi-year cycle of global digital transformation.

However, given the headwinds mentioned above, there is a higher chance that the stock will decline before rising. Globally, technology stocks have been and are likely to remain under pressure for some time. The likelihood is low that Indian tech companies can reverse this trend. Another factor likely to cause stock volatility is continued margin pressure in the current and next quarter due to rising wages, outsourcing costs and attrition. Therefore, accumulating on the dips over the next few months may be a better strategy.

Commercial and recent performance

HCL Tech is currently the 3 rd India’s largest IT services company behind CDSand Infosys. The company is well established and diversified across verticals and geographies. Financial services, manufacturing, life sciences and healthcare, and technology services are the top verticals, accounting for 21%, 18%, 16%, and 15% of revenue, respectively. The company derives approximately 64% of its revenue from North America and 28% from Europe. IT services account for 89% of revenue, while the product business (Products and Platforms segment) accounts for 11% of revenue (IT services making up the rest). Product trading performance tends to be erratic and can impact quarterly performance in both directions. However, this is part of a long-term strategy and direction for the company.

In its final June quarter, the company’s performance was mixed, with strong revenue growth offset by margin pressures. Year-over-year constant currency revenue growth in IT Services was solid at 19% (better than TCS’s 15.5% and lower than Infosys’ 21.4%), with overall growth, including products and platforms, by 15.6%. Management’s outlook commentary was optimistic, with no impact yet seen due to macro issues in the US and Europe. In fact, company CEO Vijaykumar noted that he is more bullish on demand now than he was in the prior quarter. The company maintained its constant-currency revenue growth forecast for FY23 of 12-14%.

So, while underlying business momentum remains strong, what has raised concerns are profit metrics, with operating profit (EBIT) of ₹3,992 crore coming 4.5% below the consensus and operating margins at 17%, missing the consensus expectation of 17.8%. However, on this aspect, it should be noted that margins and profits falling short of expectations was a trend seen across the spectrum of Indian IT services companies, as they are all affected by talent shortage and attrition. .

The company stuck to its FY23 operating margin guidance of 18-20%, with a comment that it will review and update it after Sep Q concludes. The analyst community is a bit skeptical, though. the company’s ability to meet its margin targets, given the wage increases that will be reflected in September Q results. On the contrary, the management is not so pessimistic because they believe they have revenue (pricing) and cost (such as the arrival of new products, the improvement of use) levers to optimize and improve profitability. How management handles attrition, which was 23.8% at the end of the first quarter (TCS at 19.7%, Infosys at 28.4%) will be a key factor to watch.

What works

In summary, given the current global trends, it looks like the near-term trend for Indian IT services may get a little bumpy when the slowdown in developed markets affects client IT budgets. However, the long-term trend remains strong with the ongoing digital transformation cycle that has many years to go. HCL appears well positioned to weather short term headwinds given its cheaper valuations and sustainable dividend yield (supported by strong annual free cash flow; net cash at 5% of market cap). In the long term, another factor likely to work in HCL’s favor is the possibility of some reduction in HCL’s valuation discount to peers like TCS and Infosys (HCL’s last 5-year EPS CAGR of 10 % is similar to that provided by the TCS).

Why accumulate

Attractive dividend yield

Reasonable valuation

Well positioned for the long term

Published on

September 03, 2022