aquaArts studio/iStock via Getty Images

Thesis article

You’re here (NASDAQ: TSLA) is a leading manufacturer of electric vehicles. The stock price is perfect, however, despite growing competition, rising material costs and a global economic slowdown. On top of that, the ongoing global energy crisis is hurting Tesla. in two ways, as I will explain in this article. All in all, that means Tesla doesn’t seem like an attractive choice at current prices, I believe.

The world is experiencing an energy crisis

Global energy hunger continues to grow, as it has for many years. At the same time, ESG mandates and regulatory pressures have led to underinvestment in (fossil) power generation, resulting in a tight supply-demand situation. On top of that, the ongoing war between Russia and Ukraine has exacerbated problems in global energy markets. This led to an explosion in energy prices for all kinds of raw materials. Rising gasoline prices got a lot of attention, but price increases were even more pronounced in other areas:

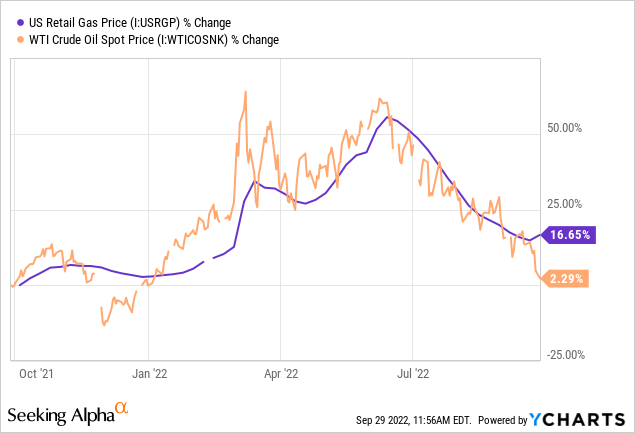

WTI has risen only a few percentage points over the past year, while gasoline has become 17% more expensive over the past twelve months. Especially in Europe and Asia, price increases for non-oil energy products have been much more drastic.

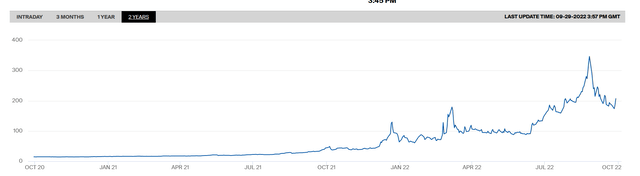

Natural gas prices in Europe, for example, have exploded by more than 1,000% in the past two years:

theice.com

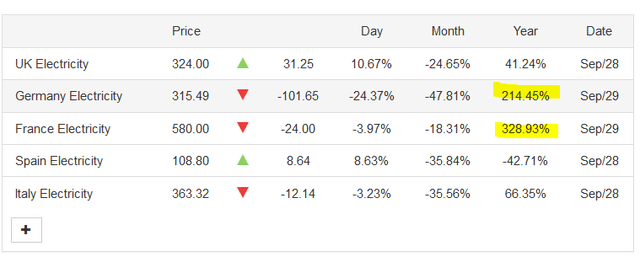

Contracts have risen from $15 two years ago to over $200 today, eclipsing rising oil prices. Natural gas in Asia, measured for example by JKM, has also become incredibly more expensive. Likewise, electricity has become much more expensive in Europe, largely due to the huge increase in natural gas prices:

tradingview.com

Market (day-ahead) electricity prices have climbed several hundred percentage points over the past year in major European countries such as Germany and France. The price increases for the coming months were even higher, for example for the coming winter months. Baseload prices for the first quarter of 2023 are north of €500 per MWh in Germany, for example. Peak prices for the same quarter are even higher, at nearly €800 per MWh.

In many other markets around the world, electricity is scarce and has also become very expensive. China is remarkable, for example. Weather anomalies in the country have led to below-average electricity generation from hydropower, leading to shortages and sharp price increases.

All in all, we can sum up that energy has become much more expensive in many parts of the world. Oil prices and gasoline prices are getting a lot of attention, but they haven’t actually risen much compared to the massive hundreds of percentage point increases we’ve seen in electricity, natural gas and even thermal coal – which has increased by 350% over the last five years. Why is this important for Tesla? Let’s dive into the details.

Impact on Tesla: things to consider

So why does it matter that the global energy crisis has led to massive increases in the price of natural gas, electricity, etc.? when it comes to investing in TSLA shares? There are several negative impacts this will have on Tesla, I believe. Some of them are specific to Tesla, others also impact other automakers.

Free Supercharger

First, Tesla will lose more money with the free lifetime supercharger it has offered in the past. With electricity prices soaring, those who can charge superchargers for free will be more inclined to do so. This means that Tesla will have to offer more electricity for free. At the same time, this electricity comes at a higher cost to Tesla, as market prices for electricity have soared in important end markets. Overall, this means Tesla will lose more money on its Lifetime Supercharger deals than previously thought.

Electric vehicles are losing their cost advantage

For a long time, electric vehicles have been touted as cheaper than ICE-powered vehicles when it comes to fuel costs. But due to the massive increase in electricity prices, compared to the more benign increase in gasoline prices, this is no longer true. Let’s take an example.

The Tesla Model 3 consumes 17 kWh per 100 km. A comparable ICE car, such as the BMW 3 Series (OTCPK: BMWYY), consumes around 5.0 liters of diesel for the same 100 km. When electricity prices were much lower than they are now, this was a clear cost advantage for Tesla. But more recently, that’s no longer true – at least not in all markets. Tesla currently sells electricity at €0.70 per kWh at its superchargers in Germany, where it recently opened one of its Gigafactories, making it an important market for Tesla. This means that driving a Model 3 for 100 km results in fuel expenses of €11.90, or about $11.50. Diesel currently costs an average of €1.98 per liter in Germany. The BMW 3 Series thus consumes €9.90, or $9.60 per 100 km. Using an ICE-powered BMW comparable to Tesla’s electric vehicle therefore costs around 20% less in fuel expenditure today in Germany. The old cost advantage for electric vehicles has turned into a cost disadvantage in Europe’s biggest market and where Tesla thought it had a lot of potential – otherwise it wouldn’t have built a Gigafactory there. In other European countries, things seem comparable. In the UK, for example, the diesel-powered BMW 3 costs around $10 per 100km, while the Tesla Model 3 costs around $11 per 100km.

This means that one of the key arguments for buying an EV, lower fuel costs, is no longer valid, at least in some of Tesla’s markets. In the United States, where the cost of electricity per kWh differs greatly from state to state, there are certain markets where electric vehicles are even cheaper to power. But even in the United States, some markets are currently more favorable to ICE vehicles, such as California with its high electricity prices. With this key argument for switching to an EV gone, EV makers such as Tesla may have a harder time convincing consumers to make the switch. Many consumers, especially those feeling the effects of the current economic downturn, will wonder why they should buy a new vehicle for several thousand dollars just to see their fuel bills increase.

Higher production costs

The battery manufacturing process is very energy intensive. This energy does not usually come in the form of oil (the price of which has only slightly increased), but usually in the form of electricity, which has become much more expensive. Battery manufacturing therefore feels a considerable cost in the current environment, and the world’s largest battery users, such as Tesla, will likely feel the greatest impact.

In Europe and China, energy-intensive manufacturing is often either unprofitable or forced to scale back due to energy-saving regulatory requirements. This will hamper Tesla’s Gigafactories in Germany and China, making them highly exposed to power/power shortages around the world. Electric vehicle companies with less exposure to Europe and China, such as Ford, which is focused on the United States, could be more advantaged in the current environment, as energy shortages are less pronounced in the States. -United.

Cash-strapped consumers could keep their cars longer

With soaring energy prices, especially in Europe, consumer confidence is plummeting. Consumers have to spend more on essentials such as electricity, heat and food, which means they have less money left over for non-essential and discretionary consumer goods.

Ultra-high-end manufacturers such as Ferrari (RACE) are likely to feel less of an impact, as middle-class households don’t buy Ferraris anyway and very wealthy consumers don’t feel much impacted by costs. higher energy. But Tesla, as well as rivals such as BMW or Audi, could feel the impact of middle/upper class consumers becoming more frugal. When essential expenses skyrocket and the risk of job loss increases due to the ongoing economic downturn, many consumers will be more reluctant to purchase an expensive new vehicle. Arguably, this is already reflected in lower wait times for many Tesla models in China, which is experiencing many of the same headwinds as Europe – rising energy costs and economic slowdown.

sum things up

Tesla is a leading company in the electric vehicle industry. Depending on whether you count plug-in hybrids or not, it’s the largest or second-largest maker of electric vehicles in the world. But the company is very expensive, trading well above 60x forward earnings, while traditional auto peers such as Mercedes (OTCPK:MBGYY) are trading at less than 5x forward earnings. Competition is intensifying, input costs are rising rapidly, and consumer discretionary companies, including Tesla, are highly exposed to a global economic slowdown.

Add in the above problems resulting from the global energy shortage, such as the diminishing benefits for electric vehicles due to high charging costs and Tesla’s rising costs for its lifetime supercharging offerings, and it doesn’t seem that Tesla is a good buy today. Last but not least, rising interest rates put pressure on all stocks, but have the greatest impact on long-lived stocks such as Tesla. All in all, I see more reason to be bearish than bullish here, which is why I think Tesla is a avoidance today, even though I don’t intend to short .