It’s finally upon us. The week that ministers from OPEC oil-producing countries and their allies meet to decide the future of their latest round of production cuts. Having failed to persuade Russia to move the meeting forward, Saudi Arabia now hopes to convince its biggest non-OPEC ally of the need to make deeper cuts in the face of declining demand triggered by the virus. Covid-19. Success is not acquired in advance and failure will be costly.

The impending pandemic has already made its mark on the oil markets. American crude West Texas Intermediate is now well below $ 50 a barrel and the world benchmark Brent briefly followed it on Friday. This is uncomfortable territory for producers around the world and, without a clear indication of larger cuts in production at this week’s meetings, prices will continue to fall.

As the virus spreads, enclosing the industrial heart of Italy and prompting Switzerland to ban large gatherings, producers seem to cling to overly optimistic demand assessments. OPEC Secretary General Mohammad Barkindo, speaking at a conference in Saudi Arabia last week, said that despite the new coronavirus, “the world’s thirst for energy will continue to grow”. While this may be true for energy as a whole, it may not be the case for oil demand this year if there is no rapid rebound.

Bloomberg

Assessments from the three major forecasting agencies still show that growth in demand for oil in 2020 will be around a million barrels a day, but that now looks very optimistic. In contrast, veteran FGE energy consultants have reduced their growth forecasts this year to “almost zero”.

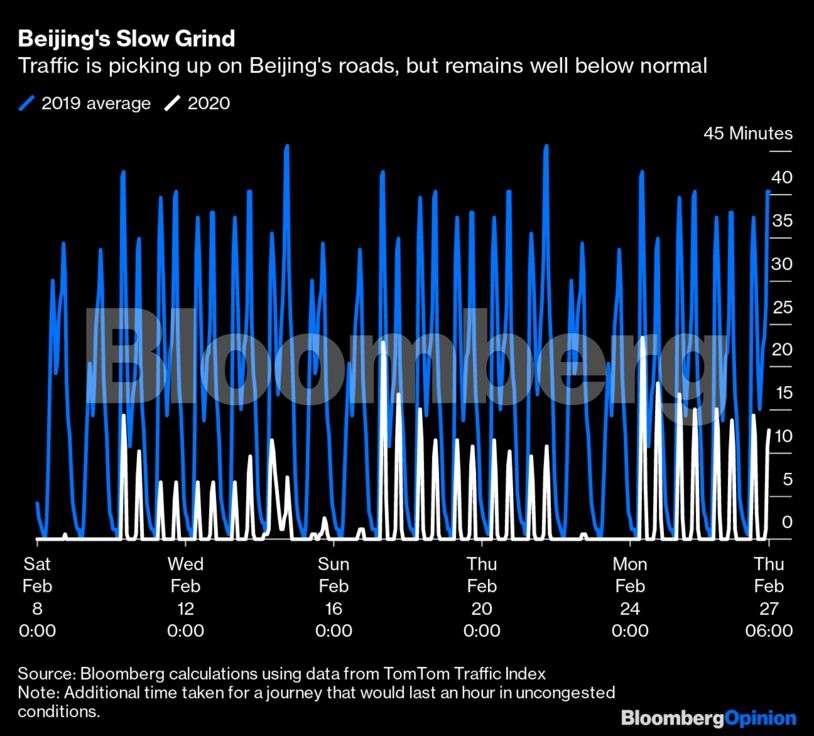

They base their pessimism on the ripple effects of the virus beyond China, where traffic volumes in the affected cities have already dropped, according to data from the TomTom Traffic Index. Measured in terms of journey times longer than on empty roads, live data shows that traffic volumes in Beijing are still well below normal levels, even when the city is back at work.

Bloomberg

In Wuhan, the center of the epidemic in China, there is no such increase; economic activity remains severely limited.

Bloomberg

But it is no longer just a Chinese problem. The economic impact of spreading the virus to other parts of the world is clear. In the U.S., the four-week average demand for kerosene has dropped 18% in the past 10 weeks. Airlines are cutting flight times and the number of passengers has collapsed. One of my acquaintances returned from Australia last weekend on a plane that he said was only about a third full. Since people are reluctant to take a flight if there is no guarantee that those around them are not infected, flight schedules will almost certainly be further reduced, with obvious implications for fuel demand. JBC Energy consultants have reduced growth in global fuel demand to just 50,000 barrels a day this year, just over a third of what they saw a month ago.

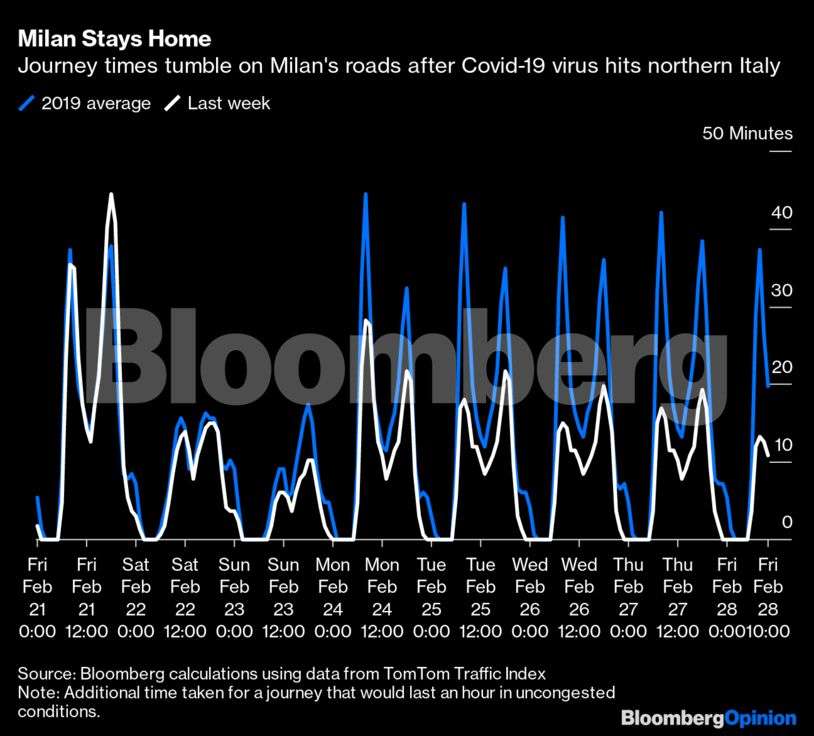

And these TomTom figures show the impact of the virus on traffic in Milan after its discovery in northern Italy. Morning rush hour travel times have been cut by a quarter as fewer cars obstruct roads.

Bloomberg

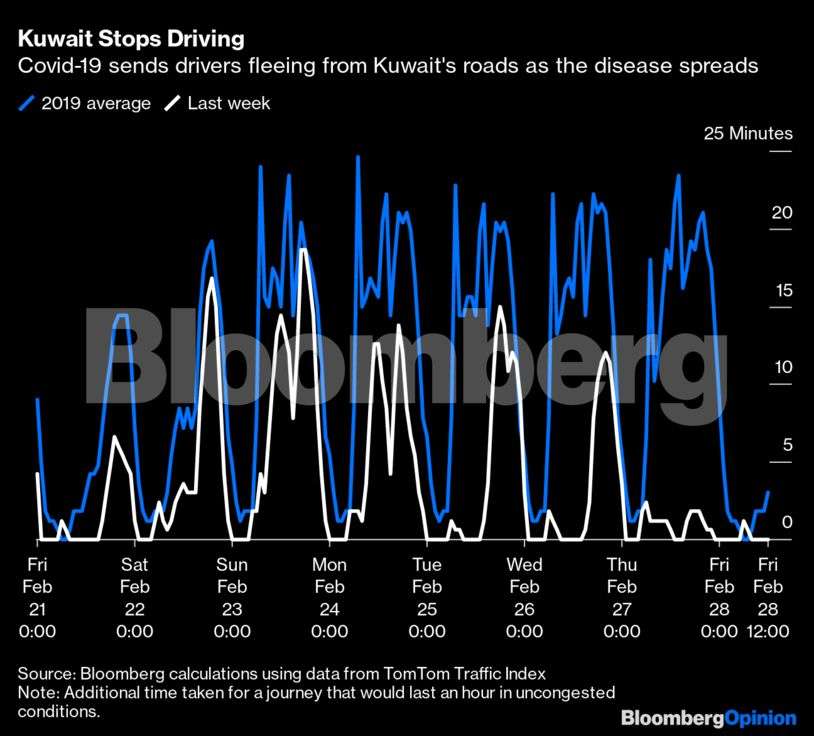

A similar pattern is emerging in Kuwait, an OPEC country, where the virus has spread from neighboring Iran.

Bloomberg

Any hope that demand will rebound last year sufficiently robustly to offset the crisis of the first half rests on precarious foundations. The canceled flights have disappeared and are not reported. Car trips not taken this week will not be made up in the coming weeks. Traffic may return to normal levels once the virus is under control, but there will be no increase beyond pent-up demand.

This is the situation that the oil ministers of the 23 OPEC + countries will face later this week. They need a credible plan that will remove the actual barrels from the market, even if Russia is reluctant to make further cuts. Compliance has been poor, but Saudi Arabia seems willing to accept that in exchange for the perceived added weight it believes Russia’s presence at the table brings.

I have no doubt that an agreement will be reached in Vienna – or via a virtual meeting if the meeting is canceled. (There are no signs yet that this will be the case, although OPEC continues to monitor the situation in Vienna). The cost of failure is too high. This “would make the market vulnerable to a short-term swing below $ 30 a barrel,” analysts Emily Ashford and Paul Horsnell of Standard Chartered said in a report.

Oil traders will remain difficult to convince that producers are doing enough or reacting quickly enough. Oil deliveries from Saudi Arabia to China are expected to decline by a third in March as demand dries up. The kingdom urges OPEC + producers to accept a reduction in collective production by an additional one million barrels a day – even that may no longer be enough.

(This column does not necessarily reflect the opinion of economictimes.com, Bloomberg LP and its owners)