This article is an on-site version of our Energy Source newsletter. Sign up here to receive the newsletter straight to your inbox every Tuesday and Thursday

Welcome to Power Source.

I have a story on the Venezuela petropolitics site. The Biden administration has eased sanctions on what U.S. oil supermajor Chevron can do in the country, allowing it to ramp up production and restart imports into the United States. The first shipment since the imposition of sanctions in 2019 could be sailing the US Gulf Coast as early as this month, I’m told.

A few big takeaways for me: This decision is not a big deal for oil markets, at least not yet. The additional supply will initially be minimal – and likely slow in coming.

But if political talks progress between Venezuelan President Nicolás Maduro and the opposition and sanctions continue to ease, larger volumes could start arriving later next year. It is definitely worth watching.

The role of US domestic politics is also fascinating. The Cuban and Venezuelan diaspora in Florida, usually a crucial electoral battleground, has been a big driver of the relatively tough policy toward leftist governments in Latin America in both Democratic and Republican administrations. Neither party wanted to alienate the groups for fear of losing a decisive electoral bloc.

But the landslide Republican victories in Florida last month could change that reckoning. The Biden administration may now feel like there is less of a political price to pay for engaging with Venezuela, especially if it can deliver a victory on fuel prices.

In today’s newsletter, Derek pulls back the curtain on Sunday’s OPEC+ meeting. The cartel is expected to stay the course on production amid a storm of market uncertainty. And Amanda has a new poll, conducted by Morning Consult exclusively for the Financial Times, showing that Americans are saving less and reducing their spending on fuel.

Thanks for reading. — justin

What to expect from this weekend’s OPEC+ meeting

Saudi Arabia, Russia and other OPEC+ members meet on Sunday – virtually, not in Vienna as planned – and rarely has the direction of the oil market been so difficult to understand. A small cut remains possible, but the most likely outcome is that the cartel holds its ground, according to people familiar with the talks, sticking to the production cuts announced last month that enraged the United States so much. Three central reasons include:

1. Russian uncertainty

The EU embargo on exports of Russian crude, including an insurance ban for vessels carrying that crude, comes into force on Monday. But as it stands, the US price cap plan has yet to be finalized by allies in Europe.

In short, the price cap is designed to give importers outside the EU a way to continue to buy Russian crude transported by sea without losing European insurance for their vessels – an exception to the embargo. But no price cap, no carve-out, no insurance. Time is running out to put the price cap plan in place.

The argument in the EU in recent days is between hawks who want the price cap set well below the prevailing market price for Russian oil, and doves who approve of the US idea of setting it at low close to this current price. Meanwhile, Russia has warned it will stop exports to anyone within the cap.

The result ? Next Monday, there is a chance that Russian oil supply will start to dip. Or a chance that it stays pretty much intact. No one can tell. And in that case, Saudi Arabia might be wiser to wait and watch, responding with more or less supply when it sees how the embargo and price cap are playing out.

2. Previous cups haven’t had much time to work yet

And anyway, the 2 million barrels per day quota cuts – the ones announced in October that angered the US so much – barely had time to tighten the market much. Refinitiv estimates that of the 1.27 million they were responsible for, OPEC members only delivered 710,000.

A perception of oversupply is visible in the futures curve for Brent, which has slid into a slight contango (a market structure in which spot prices are cheaper than oil prices delivered later). Contango can pick up its own bearish momentum, so OPEC+ will want to address that soon.

But first, it makes sense to look at what’s going on with Russian supply. A sharp decline starting next week would likely see futures (when spot prices are above futures) swing again quickly, without any cartel intervention.

3. Conflicting macro indicators

The economic signals are mixed. In recent days, independent analysts have sent a rather grim message to OPEC officials, at least regarding global demand in the coming months. The weakness of Chinese consumption remains the major concern of OPEC and other market players.

On the other hand, better news from Western economies, which some hope inflation will slow, has helped stabilize oil prices in recent days. Brent crude stood at $85.43 a barrel yesterday, about 6% higher than its low last week – hardly a price to cause panic in Riyadh.

All of this is on top of Opec+ waiting for this one and waiting for the big market event on Monday when the embargo begins.

“The last-minute change to a virtual meeting suggests there’s no need for a tussle,” Bill Farren-Price told Enverus. “A rollover would provide more time to determine how much Russian oil will be lost due to EU sanctions and whether the group’s own cuts will be sufficient to counter fragile demand.”

Helima Croft of RBC Capital Markets agreed that while the virtual meeting “increases the likelihood” of a rollover, “we expect key ministers to signal their willingness to meet quickly to address any major changes in the terms of the market that could arise in the coming weeks and months”. (Derek Brower)

What do you think OPEC+ will do? Tell us in our poll below.

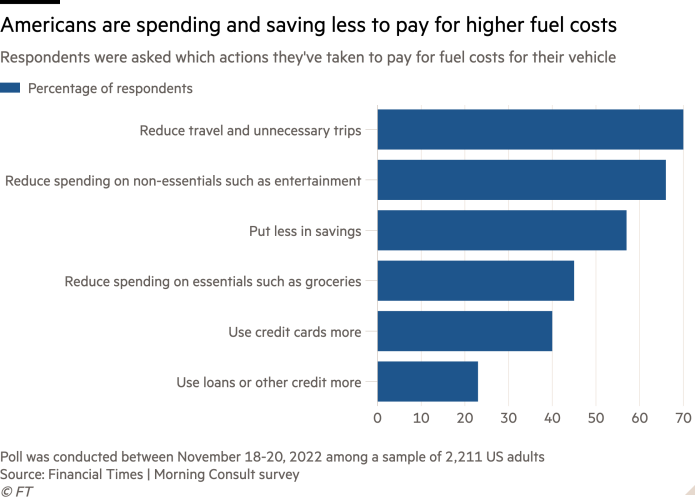

Americans are spending and saving less on fuel

Rising energy prices are driving changes in consumer spending in the United States, according to a new survey by the Financial Times and Morning Consult.

More than half of Americans said they spend less on non-essentials and save less on fuel. One in three adults said they work from home more often to avoid driving.

With energy costs in the United States pale in comparison to those in Europe and gasoline prices down from their record highs in June, polling data suggests that Americans have always struggling to afford fuel.

About one in two adults said they had difficulty getting gasoline. The share is even higher for low-income households and those without a college degree: 63% of households earning less than $50,000 a year said it was difficult to pay last month’s fuel bills.

Forty-six percent of Americans said the price of gas caused them to reduce their driving time, according to the latest US Census Household Pulse Survey.

Imminent winter utility bills are also a source of stress. One in three adults said they are concerned about their ability to pay their energy bills this winter, with the majority of respondents saying they turned down their thermostat in the hope of reducing their bill, according to the FT Morning Consult poll.

Heating bill concerns are highest for households that use fuel oil. Of this group, 83% said they were concerned about paying their bill.

Heating oil costs have skyrocketed over the past year, with the Energy Information Administration predicting a 45% increase in bills over last winter. Homes that use natural gas for heating will see a 28% year-over-year increase in their winter energy bills. (Amanda Chu)

Data mining

A handful of EU countries are buying Russian crude at the last minute before new sanctions take effect next week.

Italy imported an average of 363,000 bpd of Russian oil in November, up 30% from the previous month, according to Kpler data.

The Netherlands also continued to consume more than 100,000 bpd of Russian oil in November, although its imports have fallen by more than 75% since Russia invaded Ukraine.

“There’s a big incentive for everyone to buy if they put the political backdrop aside,” said Matt Smith, oil analyst at Kpler. “People take rough until the last minute here.”

From December 5, no EU country will be allowed to buy Russian oil transported by sea. Any tanker carrying Russian crude above a yet-to-be-determined price cap will also be barred from obtaining European insurance services.

However, oil analysts do not expect major disruptions in the oil market or Russian production. Although a price cap has not yet been decided, the proposed price of $65 a barrel is higher than the current price of Russian crude on world markets.

The embargo will likely prompt Europe to import more oil from the Middle East, and surplus Russian oil will likely move to China, India, Turkey and other Asian countries eager to buy less oil. dear. India imported nearly 900,000 bpd from Russia in November, more than nine times its purchases at the start of the year.

“It is expected that this will not be as disruptive as some originally feared,” said Neil Beveridge, CEO of AllianceBernstein. (Amanda Chu)

power points

Energy Source is a bi-weekly energy bulletin from the Financial Times. It is written and edited by Derek Brower, Myles McCormick, Justin Jacobs, Amanda Chu and Emily Goldberg.