Find out what clicks on FoxBusiness.com

Ripple Labs CEO Brad Garlinghouse says a judge, not a jury, will ultimately decide the “cryptocurrency trial of the century.”

In an interview with Fox Business on Thursday, Garlinghouse, whose company has been locked in a widely publicized legal battle with the Securities and Exchange Commission for nearly two years, said he expects the case will not be not tried because he thinks the judge has enough evidence to rule on the bench.

Last weekend, both parties filed motions for summary judgment in the Southern District of New York, asking District Judge Analisa Torres to issue a decision based on the facts presented in the respective briefs. The decision is now up to Torres whether to rule in favor of either party or let the case go to court.

DISTRICT JUDGE CALLS ON SEC OF HYPOCRISY IN RIPPLE TRIAL

But Garlinghouse is confident the latter will not happen as the facts of the case are undisputed. Judges often refer cases to juries when there is disagreement about the facts. This is different. Both parties agree that the Court can decide the case because what is primarily in dispute is the application of the law, not a dispute over facts. It is undisputed that Ripple has sold XRP over the years and it is undisputed that Ripple customers use XRP to facilitate cross-border payments on Ripple’s platform. The disagreement centers on whether XRP is a special type of security known as an investment contract that falls under the jurisdiction of the SEC. Ripple maintains that it has never entered into an investment contract with a buyer of XRP. The SEC argues that Ripple’s sales of XRP should have been registered with the SEC based on court precedent.

“Trials and juries are really about determining if there’s any uncertainty about the facts,” he said in an interview with the Claman Countdown. “The facts are not in dispute here. The law is in dispute.”

Lawyers familiar with the case told FOX Business that Judge Torres likely won’t rule on the summary judgment motions until next year.

REGULATORY RIDDLE: AN INVESTIGATION INTO THE SEC V. RIPPLE CASE AND ITS IMPLICATIONS FOR CRYPTO

The latest filing of summary judgment motions could mark a crucial milestone in the case that has dragged on for nearly two years. In December 2020, the SEC sued Ripple and its two chief executives, Brad Garlinghouse and Chris Larsen, for failing to register XRP with the commission, putting the tokens in violation of federal securities laws.

The price of XRP fell dramatically when the lawsuit was announced, and despite a rally in the 2021 bull run and a recent spike, traders are of the view that the price remains suppressed by the lawsuit.

The SEC continues to argue that because Ripple used profits from XRP sales to build its platform, buyers of the XRP token relied on Ripple’s efforts to make a profit, thereby satisfying a key requirement of the so-called Howey Test.

This 1946 Supreme Court case is the precedent that determines whether an investment is a security and falls under the supervision of the SEC or if it is a commodity like Bitcoin and therefore does not require registration with the SEC. the SEC. The Commission also alleges that by purchasing the token, XRP investors had entered into an investment contract with Ripple, similar to buying shares, meeting another requirement of the Howey test.

Brad Garlinghouse, CEO of Ripple Labs Inc., at the Milken Institute Global Conference in Beverly Hills, California, U.S. on Tuesday, October 19, 2021. The event brings together people with the capital, power, and l ‘influence (Getty Images/iStock)

Ripple maintains that it has done nothing wrong and that secondary market sales of XRP are not influenced by the company, and that no investment contract has ever existed between it and the token holders. crypto. Ripple’s legal team has expressed its belief that the SEC, particularly its Chairman Gary Gensler, is trying to overstep its authority by assuming that all cryptocurrencies are securities.

CRYPTO PROBLEM “NOT JUST IDIOSYNCRATIC” IN SPACE, SAYS INDUSTRY EXPERT

“The SEC has lost its way,” Garlinghouse said. “Congress gives power to the SEC, the SEC can’t just take power.”

Once resolved, the case could have far-reaching implications for the crypto industry. A Ripple win could mean the SEC and Gensler could be forced to take a more measured approach to regulation, possibly handing over some of its regulatory jurisdiction to the Commodities Futures Trading Commission, which provides front-line oversight of non-traders. securities such as commodities.

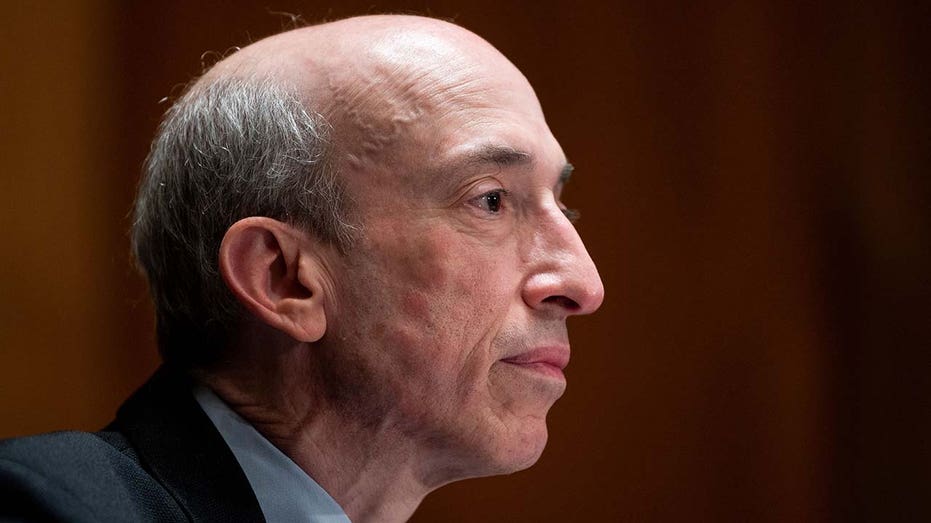

Gary Gensler, Chairman of the Securities and Exchange Commission (SEC), testifies at the Senate Banking, Housing, and Urban Affairs Committee hearing on “Oversight of the United States Securities and Exchange Commission” on September 14 2021 in Washington, DC. ( ((Photo by BILL CLARK/POOL/AFP via Getty Images) / Getty Images)

An SEC victory could see the agency expand its crypto regulation far beyond XRP; some industry experts say the SEC could launch a similar case against Ether, the native token of the Ethereum blockchain and the second most valuable crypto after Bitcoin. The Ethereum platform was partially funded by the sale of unregistered tokens, known as the Initial Coin Offering, in 2014.

CLICK HERE TO LEARN MORE ABOUT FOX BUSINESS

Since taking office, Gensler has noticeably avoided questioning whether he believed Ether to be a security despite the token being considered exempt from SEC oversight under former SEC Chairman Jay Clayton. . Earlier this month, Gensler signaled that he would support the CFTC having regulation on Bitcoin, which he says is likely a commodity.

The SEC had no comment.