Antonio Solano

An earnings report does not create a trend, but it got me thinking.

My eyes were opened by the earnings report from PNC Financial Services (PNC). PNC Financial’s Q3 earnings beat on strong operating leverage. “We have increased lending and revenue, our net interest margin increased and expenses remained well controlled, resulting in substantial positive operating leverage,” said PNC Chairman and CEO Bill Demchak. . A regional super like PNC has credit cards, business loans, mortgages and wealth management. While mortgages are at a standstill. It seems to me that old-fashioned banking – taking deposits and then making loans should be a very fine business indeed. I’m not sorry for the likes of Morgan Stanley (MRS) et al., they will soon raise the bar as the economy normalizes. Regional banks will be on the front line. So you might have two questions (besides questioning my sanity of course), the first is why now, and the second is who are these banks going to lend to as we enter a recession? Let’s take the first, why now? Well, one of the only good things about the Fed right now is that interest rates are going up. This will increase the NIM, the net interest margin, which is the difference between what the bank distributes to depositors (close to zero) and the interest rate it can charge for loans, which will be much, much higher raised.

Traditional banks make up a larger portion of regional banks than they do with currency center banks. Regional banks rely more on their balance sheet in terms of earning potential. A rising rate environment will help regional banks more than those dependent on capital markets. In reference to the “fintech world” which does not take deposits and raises funds via bonds to develop. Generating income will be even more difficult than when interest rates were virtually zero. Less competition means higher margins, which translates to higher net interest income.

After the last rate hike, Mike Mayo, the most well-known banking analyst, talked about the banks. The statement was for the banking sector in general, but of course regional banks as well, the Federal Reserve raised rates by $0.75 in September and by 3 percentage points over the past six months. “What seems underestimated is the extent to which industry NIMs are expected to return closer to normal after being phased out over the past 14 years with virtually zero rates,” he said. declared.

So what do I mean by Regional Banks are the next oil?

A sign of the times, banks may have lower loan volume due to an economic downturn, but margins will be much higher per loan. Doesn’t that sound a little familiar? Oil companies don’t try to increase production aggressively because they know they will earn more per barrel with less expense if they slow production increases. Similar to the automotive industry, although in this case the big 3 automakers couldn’t build more cars due to shortage of chips. Yet they discovered by accident that they were making much higher profits by making fewer cars. I think banks may have a similar opportunity. I also wonder if this is not a macro trend, and it is not necessarily inflation. Banks might decide to compete by raising interest rates on deposits, lowering their lending rates and spending more on advertising, but why would they do that? I guess some economists will put a name to this phenomenon and get a Nobel Prize for their trouble. For our purposes, I think the rate hikes will primarily benefit the regional banks. So with less competition for loans and more profit on each additional loan, I see the financial industry starting to show growth. As I often mention, I write to organize my thoughts and my approach to the market, and analyze the past week. In this case, I’m still working on the regional banking opportunity. I know I can get the Regional Banking ETF (KRE) for a long time, but I prefer to research individual names. The main reason I’m not ready to jump in is that I think it’s a bit early. I would like to see how the other regional banks behave and how the sector reacts to the next rate hike. So I’ll let you know in a few weeks if that really makes sense.

Yes, we’re still at rock bottom: Now for an update on the overall market

These wild oscillations whose frequency increases are indicative of the dip process. No one said this market shift would be easy. The bears clearly had the upper hand for most of the year. Yet the economy did not break, much to the chagrin, it seems, of the Fed and the FOMC. They know that if they break the economy, they have broken the back of inflation. The Fed should be careful what it wishes. Beneath this cyclical trend of fiscally irresponsible spending lies the true secular trend of disinflation due to technological advancement. If the Fed pushes too hard, it could cause DEFLATION. Something that has strangled the Japanese economy for decades.

Commercial view

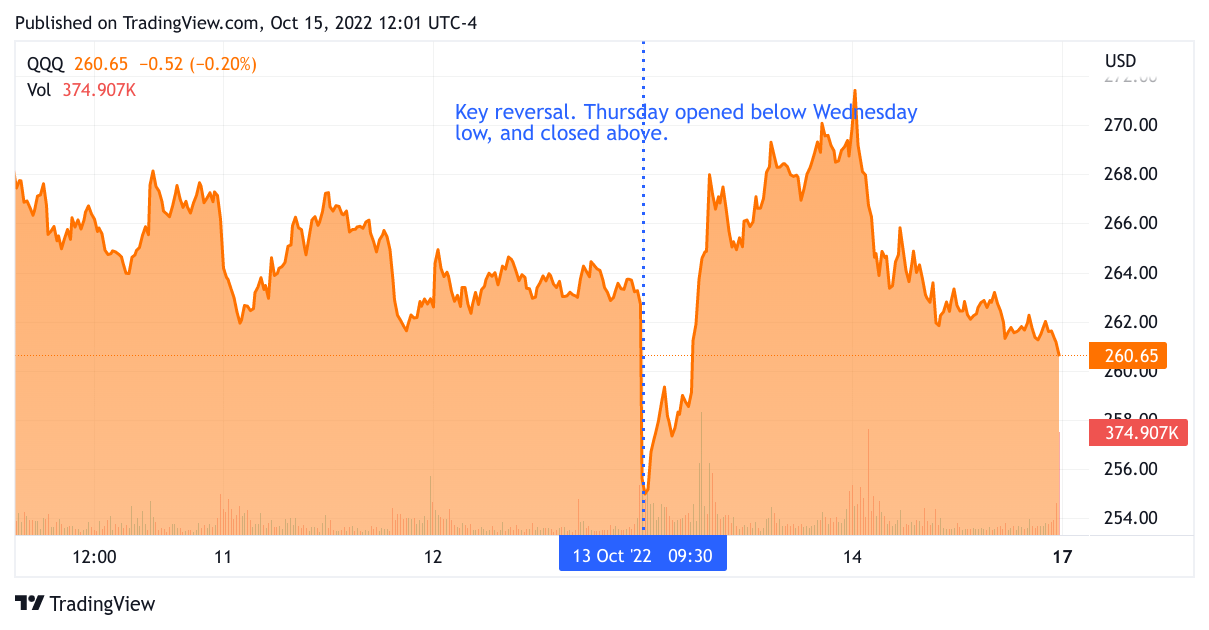

The chart above is a 5-day chart of the S&P 500 ETF (SPY). The dotted vertical line shows that the index fell below the recent low, and also below the previous day’s low, then the SPY climbed above the previous day’s high, then climbed much higher . It was a massive turnaround. The S&P 500 fell 2.4% before ending up 2.6%, a change of five points. You see this kind of price action towards the lows. So a little more patience

My exchanges

This week we have organized a trading plan focused on the CPI report on Thursday. We generated cash to prepare and hedge. Our premise was that the market would sell off in the CPI report. As the week progressed, we (Dual Mind Research Community) supplemented our coverage – primarily SQQQ Inverted 3X ETFs. On the morning of the report entering the report at 8:30, we closed this position (in the pre-market). Our assumption was that the market would rally after the CPI whether the news was bad or not. Although honestly, we expected the CPI report to be at least in line with expectations or lower. Still, the market was so oversold that we were confident the rally would reassert itself, so we started taking long positions. A number of community members traded against the bullish 3X TQQQ ETF for a faster trade. I preferred to add to my “go to” technology names – Amazon (AMZN), Alphabet (GOOGL) and Microsoft (MSFT), also added to my Boeing (BA) position. Fast traders in the group hit the high on Thursday at the close. On Friday morning, it was time to rebuild the inverse 3X ETF – SQQQ again. Unfortunately, I was too slow to really catch enough SQQQs at an appreciable level, but several other community members closed half of their positions for more alpha. I don’t mind that my members are doing better than me, in fact, I’d rather it be that way than not.

As for what we do next, our assumption is that we’re running out of sellers. Most of the selling pressure comes from short sellers and a thin veneer of market participants who can still be squeezed out of positions. Thursday’s volume was much higher than Friday’s. To me, that means there are far too many traders leaning to one side of the boat (being short). Any little bit of positive news, like a slew of positive earnings reports, and wham o, another huge tear higher. So I’m going to be tactically optimistic.