bjdlzx

(Note: This article originally appeared in the August 7, 2022 newsletter and has been updated as needed.)

Ranger Oil (NASDAQ: ROCC) is more than nimble enough to keep adding to a decently sized Eagle Ford stance. The company is nimble take small positions at a discount, as they are worth much more when tied to the company’s decently sized presence in the Eagle Ford. The strategy of buying from so-called unnatural or sub-optimal property leases is generally profitable throughout the cycle because sales from these owners are normally at a significant discount to the “list price “.

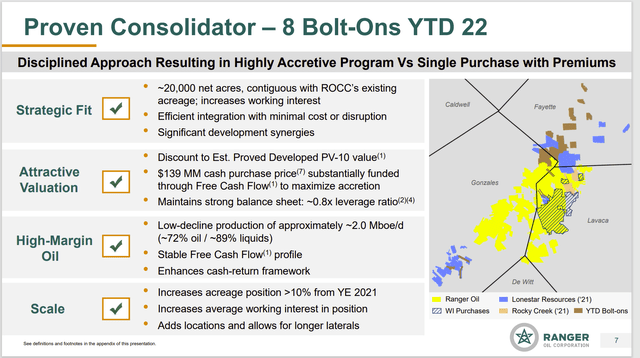

Ranger Oil Map of recent acquisitions. (Ranger Oil second quarter 2022, earnings conference call slides)

Back when management acquired Juniper, so many people wondered why a company like this would need the money. Admittedly, part of this money was used to repay a debt which then enabled the company to successfully launch a bond issue. But at the time, there was still a lot of money left.

The reason is stated above. Management says $149 million was paid to gain 20,000 acres (and actually more). The acreage cost alone (if that was all management really got for their money) is about $7,000 per acre. That’s a fantastic price for a decent acreage of Eagle Ford at pretty much any point in the market cycle. As the slide above shows, management has also acquired working interests, so the deal for overall square footage turns out to be even better. To be clear, management clawed back more than just square footage based on the deal.

This highlights a major problem small tenants have. The sales market is largely limited to larger neighbors who want a complementary acquisition that enhances their already large holdings. Thus, the market for small positions is not very liquid and very uncompetitive.

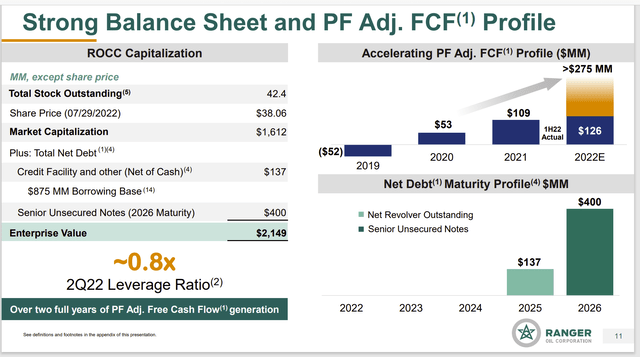

long-term debt

The Juniper acquisition, which also involved a cash injection, largely allowed management to buy a fair amount of acreage and working stakes while keeping debt at a conservative level. Of course, the strength in commodity prices also helps.

Ranger Oil Enterprise Value Calculation and Free Cash Flow Direction (Ranger Oil Corporation, Q2 2022, Earnings Conference Call Slides)

Management deftly maintained balance on the low revolver while retaining the ability to make accretive acquisitions using the revolver. The result is a stock buyback program combined with an ongoing acquisition program that can be funded in cash flow (but not exactly quarterly). The overall debt ratio remains low enough to ensure adequate access to debt markets.

Management also managed the line of credit to steadily increase this committed amount as the borrowing base grew. Conservative management would normally guide the choice of a commitment that can be maintained when the borrowing base is weaker due to low commodity prices.

The Eagle Ford has a large number of smaller operators than one would normally assume for a large production basin. This allows consolidation opportunities to be pursued. Small acquisitions like the ones the company continues to make tend to be very low risk and easy to digest. It is also a low-risk way to increase production.

Between the share buybacks and the acquisition program, production and earnings are expected to grow at a faster rate than competitors who are growing solely through organic growth (drilling). As the purchase price and acreage shown in the slide above show, this appears to be much cheaper than what operations can produce at present.

Earnings

Back when the Juniper deal was struck, many investors at the time wondered if it meant that previous peak earnings would be halved this time around to all shares outstanding. But management was never going to just “sit on the money” and do nothing. Of course, it helps that commodity prices are much higher than anyone expected at the time of the deal. Again, earnings were just over $3 per share in the current quarter.

Management has added a fair amount to the company through acquisitions and also drilled to increase production. Management noted that the acquired production has gradually increased guidance as well as some outperformance. It doesn’t take a lot of “pushes” to dramatically increase long-term performance. As long as the leverage ratio remains conservative, let management continue with the current strategy, as it looks good so far.

This indicates that the resources acquired through the Juniper deal were not just accretive. But now the benefits accrue as long as management continues to land accretive bargains. Considering the small size of each individual trade, I like the chances of even more benefits in the future through future trades.

The risk with a strategy like this is a tendency to make a big deal sooner or later. Large transactions are more risky. So of course they have a lower success rate. The bigger issue from a shareholder perspective is that a larger deal that doesn’t work out could take a few years to recover. But a small matter that does not come to fruition can often be overcome in a quarter or less.

The future

Management is (strongly) implying that the stock is undervalued. The difference here is Eagle Ford’s highly profitable acreage combined with a combination of organic growth and low-risk acquisitions.

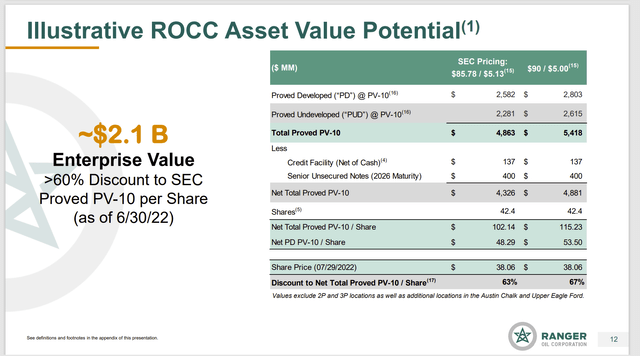

Ranger Oil Corporation Reserves Valuation to Enterprise Value Comparison (Ranger Oil Corporation Q2 2022, Earnings Conference Call Slides)

There are many reasons why companies never trade close to their reserve value. The most important of these is cash flow versus reserve value.

One of the reasons is illustrated by the latest drop in commodity prices. Investors are very uncertain about the future strength of commodity prices. Still, the Eagle Ford is one of the cheapest basins. So the message from the slide above should still apply in general (even if we plug in the current stock price).

But that’s where this little add-on acquisition strategy will play a big role. As noted above, management paid around $7,000 per acre using the bolt-on strategy. This means a location cost for a well on a 100 acre spacing (eg $700,000).

Meanwhile, a lot of managements pay (say) $50,000 an acre or more for good acreage in a basin like Eagle Ford or Permian. A management paying $50,000 per acre has a location cost of $5 million per well with a spacing of 100 acres.

Obviously, this management is going to show a lot more cash flow for every dollar spent. This makes the goal of eventually exchanging reserves realistic. This management will not spend as much per well as someone who insists on buying a marketable size acquisition. Assuming both companies pick the geology with equal opportunity, the one that makes small add-on acquisitions will be much more profitable and will likely trade at a premium because it is more profitable.

It takes extra work to “consolidate” a bunch of small acquisitions into one very profitable holding company. But it is definitely worth it for the shareholders. This direction is clearly going the extra mile. Sooner or later the market will notice this as long as management sticks to the current strategy and remains disciplined. The stock value calculated by management should prove to be a very reasonable target over the current 5-year period. All management needs is some time. They’ve clearly had more than enough practice.