Hedge funds that use powerful computers to manage their portfolios are making huge profits in this year’s market turmoil, marking a resurgence for a sector trying to recover from a long period of poor performance.

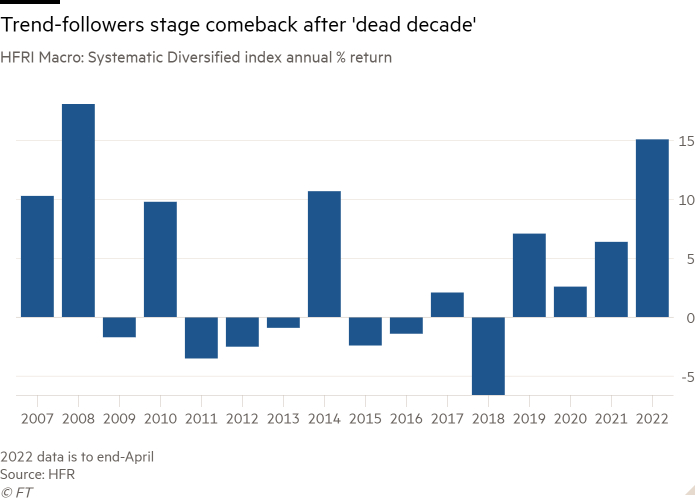

Trend-following hedge funds, which use mathematical models to try to predict market movements, have struggled for years in an era dominated by central bank bond buying – a stimulus tool that has suppressed much of the volatility they thrive on. But the $337 billion industry is now making its biggest gains since the 2008 financial crisis, according to data provider HFR.

These quantitative funds notably benefited from bets against government bonds, which were undermined by expectations that the Federal Reserve would continue to aggressively raise interest rates to combat high inflation.

They also benefited from soaring energy and commodity prices, fueled by supply chain bottlenecks and Russia’s invasion of Ukraine.

“Now it’s one of those times in 2008 where everyone [in trend-following] going well again. The trends are clearer,” said Leda Braga, founder of Systematica Investments and former head of systematic trading at BlueCrest.

“The only underlying theme has been the end of the benign decade we’ve had,” added Braga, whose BlueTrend fund is up 26% so far in 2022, its best performance in 14 years. “Now there is more volatility.”

Among the winners is BH-DG Systematic, a joint venture between David Gorton and hedge fund Brevan Howard. It has gained 32% since the start of the year. Aspect Capital, co-founded by Martin Lueck, one of three founders of Man Group’s AHL unit, gained 29.2% in its diversified fund, its second-best calendar year since its launch in 1999.

These quantitative funds gained an average of 15.1% in the first four months of the year, according to HFR data, ranking them as the best-performing hedge fund category in a period in which many many high-profile managers posted double-digit losses and the S&P 500 fell 13%. The hedge fund industry as a whole is down 1.9% in the four months to the end of April.

These quantitative funds – also known as managed futures funds – can make money by latching onto persistent price trends in up and down markets, which has often allowed them to profit during periods of market stress. In 2008, for example, they benefited from both a sharp rise and then a collapse in oil prices and a rapid sell-off in stocks as the financial crisis reached its climax.

The sharp uptick in performance this year comes after years of often poor returns, with trend followers losing money in all six of the eight calendar years between 2011 and 2018, according to HFR. The period after 2010 “has been a dead decade” for trend followers, a senior industry executive has said.

Waiting for a return has proven too long for some funds. Billionaire David Harding, another former AHL co-founder who started quantitative firm Winton in the 1990s, caused controversy in the industry several years ago when he moved his main fund away from trend tracking. , arguing that the strategy did not earn enough to justify running a large hedge fund.

“It was then impossible to raise funds” after Harding’s move, said a fund manager who continued to support trend following. Last year, GSA Capital closed its Trend fund after discovering that meeting with the fund’s investors had become a distraction for its researchers.

However, a sharp acceleration in US inflation last year, initially underestimated by central bankers, catalyzed higher interest rates and the withdrawal of quantitative easing. This removed support for asset prices in traditional markets, sending bonds and stocks tumbling.

“Central banks need to focus on fighting inflation despite the cost of asset prices,” said Philippe Jordan, chairman of Paris-based quantitative hedge fund firm CFM, whose trend fund IST has risen. 16.5% this year. “It’s a positive backdrop for the trend because it builds momentum.”

The yield on the 10-year US Treasury rose from 1.51% to a high of 3.2% this year, while the yield on the Bund, which turned negative in 2019, rose from minus 0.18% to 1 .19%. Yields move in the opposite direction to prices.

“If you look at the German 10-year-old, there’s been a staggering move for something that’s been doing absolutely nothing for a long time,” said Kenneth Tropin, chairman of Connecticut-based Graham Capital, whose K415 fund rose by 41.7% this year, while the Tactical Trend fund gained 33.4%.

“Given what’s happened in rates, commodities and currencies, managed futures funds are like pigs in the mud,” said Andrew Beer, managing member of US investment firm Dynamic. Beta Investments, whose DBMF fund is up 22.4% this year.

After a relatively tough time for the sector, managers now think the change in market regime means the trends could last for a while.

“The change in inflationary expectations looks like a big barge and is going to take time to turn around,” Systematica’s Braga said, pointing to decarbonization and changes in supply chains as inflationary forces. “It looks like the cycle is longer and I suspect the trends will persist for some time.”