European markets close lower

European markets temporarily closed 0.4% lower on Thursday, with most sectors and major exchanges in negative territory.

Banking and telecom stocks led the losses, falling 2.4% and 2.1% respectively.

—Sam Meredith

US stocks open slightly higher

US stocks opened slightly higher as Wall Street continued to digest Wednesday’s higher-than-expected inflation figures.

The tech-heavy Nasdaq rose 0.4% while the S&P 500 gained 0.1%. The Dow Jones Industrial Average fell 0.1%.

Stocks on the move: Aviva down 6%, AstraZeneca up 3%

Shares of a British insurance company Aviva fell 6% after announcing new plans to “rebuild and rebrand” its financial lines business.

In the meantime, AstraZeneca rose 3% thanks to its commitment to increase its dividend this year ahead of a key vote on its chief executive’s pay.

-Karen Gilchrist

The ECB keeps its interest rates stable but announces a future cut

A Euro sculpture stands in the city center of Frankfurt am Main, western Germany, January 25, 2024.

Kirill Kudryavtsev | Afp | Getty Images

The European Central Bank kept interest rates unchanged for the fifth consecutive meeting on Thursday, but confirmed its wording regarding a possible future cut.

“Should the Governing Council’s updated assessment of the inflation outlook, underlying inflation dynamics and the strength of monetary policy transmission further strengthen its confidence that inflation converges towards the objective in a sustainable manner, it would be appropriate to reduce the current level of monetary policy restraint,” she said in a statement.

Market prices currently suggest a 25 basis point decline in June, according to LSEG data.

-Karen Gilchrist

The ECB should maintain its position, but the signal will soon be cut

Christine Lagarde, President of the European Central Bank, during the ECB And Its Watchers conference in Frankfurt, Germany, March 20, 2024.

Bloomberg | Bloomberg | Getty Images

The European Central Bank is expected to announce a hold on interest rates on Thursday afternoon, paving the way for a possible cut in June.

ECB President Christine Lagarde suggested at the March meeting that a rate cut in June was a firm possibility. Since then, eurozone inflation has fallen more than expected, reaching 2.4% in March.

“Policymakers will remain very sensitive to upcoming data, but in our view, they should begin the rate cut cycle in June. As the year progresses, we expect quarter-point reductions at the remaining meetings, which should bring the deposit rate down to 2.75% at the end of the year,” Henk said Potts, market strategist at Barclays Private Bank, in a note.

The decision will be made public at 2:15 p.m. Frankfurt time, ahead of a press conference by Lagarde.

-Jenni Reid

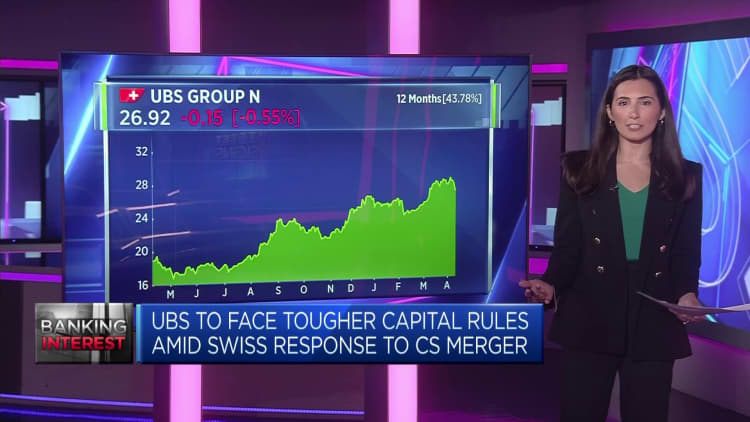

UBS down 1.2% after Swiss government proposes new banking laws

UBS Stocks fell 1.2% Thursday morning after the Swiss government proposed 22 measures aimed at strengthening its oversight of banks deemed “too big to fail.”

It comes a year after authorities negotiated UBS’s emergency bailout of struggling rival Credit Suisse, creating the biggest merger of two systemically important banks since the global financial crisis.

The regulations could limit UBS’s ability to compete with Wall Street giants, Beat Wittmann, a partner at Zurich-based Porta Advisors, told CNBC’s “Squawk Box Europe.”

Wittmann said this “creates a lose-lose situation for the Swiss financial center and for UBS which cannot develop its potential.”

“It comes down to a level regulatory playing field. It’s of course about skills and then incentives and the regulatory framework, and the regulatory framework, like capital requirements, is an exercise globally,” he added.

Learn more here.

—Elliot Smith, Jenni Reid

UK cybersecurity firm Darktrace up 7% on higher revenue and forecast hike

Darktrace stock price.

Shares of a British cybersecurity company Dark trace were up 7% as of 9:45 a.m. in London after a third-quarter trading update reported year-over-year revenue growth of 26.5% to $176.1 million.

The company, a popular technology player on the London Stock Exchange, also said it expected its adjusted profit margin to be higher than the previous forecast of 21% and raised its revenue growth forecast for the whole year by 0.5 percentage points.

Ben Barringer, technology analyst at Quilter Cheviot, said the results showed “strong, consistent growth as well as another beat and rise,” and noted that Darktrace “continues to be undervalued relative to its U.S. peers “.

The improvement in annualized recurring net sales was a highlight, he added.

-Jenni Reid

Societe Generale up 4% after completing the sale of its equipment finance unit for $1.18 billion

Societe Generale share price.

Societe Generale topped the Stoxx 600’s gains in morning trading, rising 4% to its highest level since September 2023.

The French bank announced Thursday that it had agreed to sell its equipment financing activities to Groupe BPCE for 1.1 billion euros ($1.182 billion), which would bring an expected improvement of 25 basis points to its CET1 ratio , a measure of capital relative to assets.

The deal is expected to be finalized in the first quarter of 2025, it said.

Companies had outstanding credit of around 15 billion euros at the end of December 2023.

Societe Generale said the deal was a step forward toward its goal of creating a more “streamlined, more synergistic and more efficient” business model, while strengthening its capital base.

-Jenni Reid

European stock markets open mixed

European markets were mixed early Thursday, with France’s CAC 40 and Britain’s FTSE 100 up about 0.1% and Germany’s DAX flat.

THE Stoxx 600 the index was also close to the flat line.

Stoxx 600 index.

Fed should cut rates before ECB, says former BoE member

The Federal Reserve building is located in Washington.

Joshua Roberts | Reuters

The US Federal Reserve will likely cut interest rates before the European Central Bank, a former Bank of England member has said, defying current market expectations.

“I suspect the Fed will be the first to actually reduce investment,” DeAnne Julius, a founding member of the Bank of England’s monetary policy committee, told CNBC on Tuesday.

Julius explained that his forecast was based on the Fed’s dual mandate, which focuses on both inflation and employment in the U.S. economy. The latest employment figures show a buoyant US labor market and inflation has also fallen, although it remains above the Fed’s 2% target.

Read the full story here.

—Silvia Amaro

CNBC Pro: Citi Says This ‘High Risk’ But ‘Attractive’ Global Stock Has 280% Upside Potential

Citi has identified a digital advertising and marketing services company as a high-risk but potentially attractive investment opportunity.

Analysts at the investment bank stressed that while the near-term outlook remains unclear, “there are potentially still many reasons to remain excited about the medium term.”

The Wall Street bank expects the “attractive” but “high-risk” stock could rise 280% over the next 12 months.

CNBC Pro subscribers can learn more here.

-Ganesh Rao

CNBC Pro: Beyond the US: Investment analyst names the markets – and stocks – he’s betting on right now

Attractive returns and breadth of opportunities have always been among the many reasons why the United States has reigned supreme among investors.

Although the global superpower still has “some areas that look good” in terms of value, investment analyst Steven Glass of Pella Funds Management is eyeing opportunities in other geographies.

“There are still some areas that look interesting, but in general it’s outside the United States,” said Glass, the investment firm’s chief executive, naming the markets — and stocks — in which he is currently betting.

CNBC Pro subscribers can learn more here.

-Amala Balakrishner

European markets: here are the opening calls

European markets are expected to open mixed on Monday.

The United Kingdom FTSE100 index expected to open 41 points lower at 7,952, according to German index DAX up 23 points to 17,921, the CAC 4 points more at 8,004 and that of Italy MIB FTSE down 8 points to 33,112, according to IG data.

The data released includes Israeli inflation figures for March. There are no major results published.

—Houx Ellyatt