Olemedia/E+ via Getty Images

The extraordinary rise of cryptocurrencies in recent years, and especially from the end of 2020, has led to a variety of exchange-traded products in the class. One of the issues facing cryptocurrencies is that the process of owning digital coins has been a little more cumbersome than owning traditional stocks and ETFs, in that the investor needs a wallet or other form of crypto account. There have been countless examples of fraudulent activity on unscrupulous crypto exchanges over the years, digital wallet thefts, and other unsavory impacts of this model.

However, the normalization of cryptocurrencies, including the mothership Bitcoin (BTC-USD), has done wonders for the industry. The larger coins are now available to investors in the United States through exchange-traded products that can be bought and sold throughout the trading day with a standard brokerage account. This has dramatically increased the accessibility of digital coins, and as I have said many times in my crypto work, this is a long-term bullish sign.

Enter a new ETF

One of the new entrants is the ProShares Bitcoin Strategy ETF (BITO), which claims to be the first US Bitcoin-linked ETF. The fund does not own actual coins, but instead invests in near-Bitcoin futures to mimic returns. The question then becomes whether or not this is a truly viable alternative to buying the coin itself.

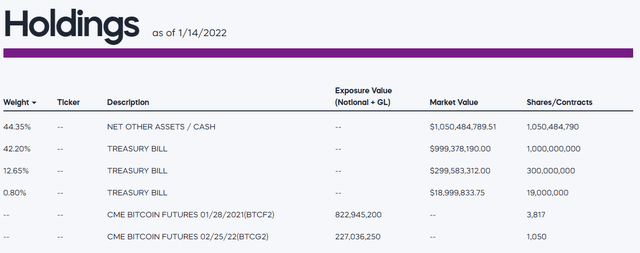

Fund website

The fund’s holdings consist of cash and cash equivalents, and nearly 5,000 Bitcoin futures contracts, the lion’s share of which is for the end of January. One thing that has plagued some other ETFs that invest in futures products is that contango and offset can have a big impact on returns and therefore tracking error with the commodity they are meant to track. . However, as we’ll see below, one of the things I love about BITO is that – at least for now – it doesn’t have this problem.

CME

The current month-to-month Bitcoin futures price structure shows that there is almost no difference in sight for March. This means that the frictional loss (or gain) of the rolling contracts is basically nothing, which then improves BITO’s ability to mimic the price action of the spot price of a simple purchase of Bitcoin. To that extent, BITO is a great way to gain exposure to Bitcoin without the traditional friction costs of futures exchange-traded products.

The last advantage I will highlight for BITO for retail investors is that the ETF already has weekly options available, which means you can do things like sell covered calls, sell cash-backed put options, buy /sell spreads or a number of other options. strategies. You don’t just have to buy the coin and hope it goes higher; with BITO you can express any number of neutral, bullish or bearish positions on bitcoin. This is a huge advantage and again it is available in a standard brokerage account.

Is BITO good?

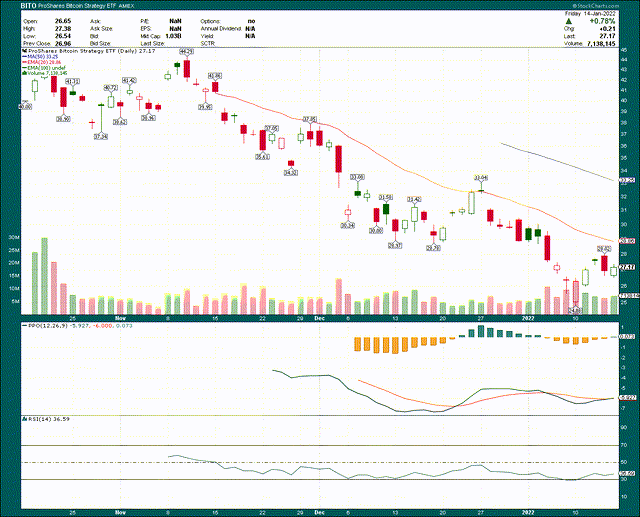

Now let’s look at the charts to see if BITO is good at tracking Bitcoin. BITO has only been online since October and obviously it has been a tough time for cryptos.

Stock charts

BITO lost a huge amount of value in this short period, and since the period is so short, we cannot gain much on the price chart. However, what we can do is look at whether or not BITO actually correlates to Bitcoin and then look at the chart of the coin itself.

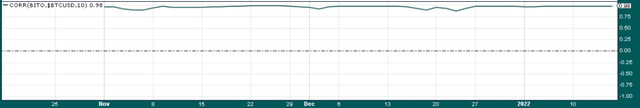

Below, I have plotted the 10-day correlation of BITO to Bitcoin, and the results are outstanding.

Stock charts

The current correlation is 0.98, and he has been in this field almost his entire existence. It’s not a perfect correlation with Bitcoin, but in my eyes it’s pretty close to perfect.

Bitcoin’s price action appears to be bottoming out

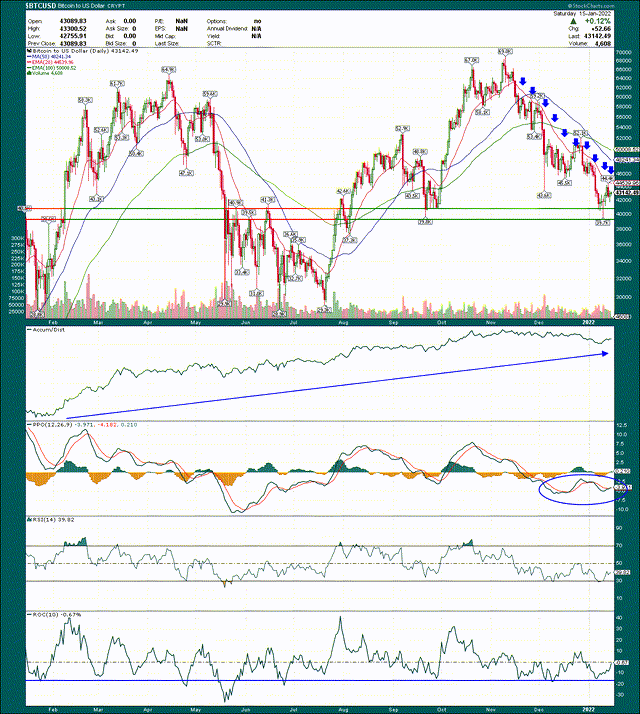

This then means that we can look at the chart of Bitcoin itself to determine the direction of BITO, with the understanding that we should see an almost perfectly correlated move in BITO.

Stock charts

Nothing about Bitcoin has been bullish since November’s high, just after BITO started trading. The coin lost a huge amount of value, and I was on the wrong end of it for part of that drop. You live and learn, and you move on to the next job. What I see now is a bit of a crossroads for Bitcoin, and therefore BITO.

Bitcoin has very strong support which I annotated above, with two low peaks at just under $40,000 and then candle body support at ~$41,000. Both have been successfully tested several times and together form a support zone that at hold. If we see the coin slice through this support, we could easily see the $30,000 region or even a full test of the $30,000 area. Personally, I don’t think we’re that low, but the mid $30,000 range is still a possibility if the support zone I mentioned doesn’t hold. Early signs are good, but it’s something to keep in mind for your risk metrics.

We have a crossroads as Bitcoin price, major moving averages, and the support area I identified are all converging very quickly. That means we’ll get a resolution one way or the other pretty quickly.

My bias is still up as the accumulation/distribution line remains very close to its all-time high, and there is positive divergence forming on the 14-day PPO and RSI. A positive divergence occurs when momentum is flat or rising as the price hits a new low, which is what the past few weeks have produced with Bitcoin. This does not guarantee that it is at its lowest, but greatly increases the chances that it is. When positive divergences form in conjunction with major support levels, you should take this into account, as the chances of a medium-term bottom forming are quite good.

Finally, the rate of change, or ROC, which is plotted in the final panel, has been a great indicator of short-term lows in the past. Different timeframes produce different results, but on the 10-day ROC, -15% proved to be an awesome place to recover Bitcoin before a bounce, and that continues to be true. The ROC can also help you find places to sell hard if it is rising too quickly, but for now the ROC confirms the idea that Bitcoin may have seen its mid-low with that most recent peak at just under $40,000.

The bottom line

The bottom line on this one is that I personally think BITO is an exceptional alternative to buying the coin itself. It has almost no tracking error, it can be held in any standard brokerage account, and it has weekly options if you want to express bearish or neutral Bitcoin strategies. In my opinion, BITO fixes all the problems of owning cryptos in a wallet, and whether you are bullish, bearish or neutral on Bitcoin, BITO is a much better alternative than the coin itself.