mini

ICICI Direct has included auto, computer, bank and tire stocks in its Samvat 2079 selections.

Brokerage firm ICICI Direct expects medium-term volatility to be a great opportunity to gain exposure to Indian equities. They have set a one-year Nifty 50 target at 19,425, indicating a potential upside of 13% from October 16 closing levels.

The brokerage expects India Inc. to post double-digit earnings growth over the next two years, given the current economic scenario. However, he expects global central banks to remain hawkish and India’s Reserve Bank of India to follow suit.

Based on the criteria of strong earnings growth and visibility, stable cash flow, return on equity and return on capital employed, ICICI Direct has shortlisted 10 stocks it recommends investors buy for the next Samvat 2079.

ICICI Direct expects the private sector lender to achieve compound loan growth of 16.3% over the next two fiscal years. With cumulative reserves at 134% of gross NPAs, the brokerage finds comfort in the bank’s asset quality and earnings volatility. He also expects lower provisions to translate into lower borrowing costs and therefore higher profits.

The upward revision of its credit growth forecast to 15-18% encourages ICICI Direct to bet on this private lender. Management expects recoveries and upgrades to be higher, relative to new slippages in the current fiscal year. However, the brokerage has warned that larger slippages from the restructured book could play spoilsport. He expects the bank to continue reporting higher business growth without any significant dilution.

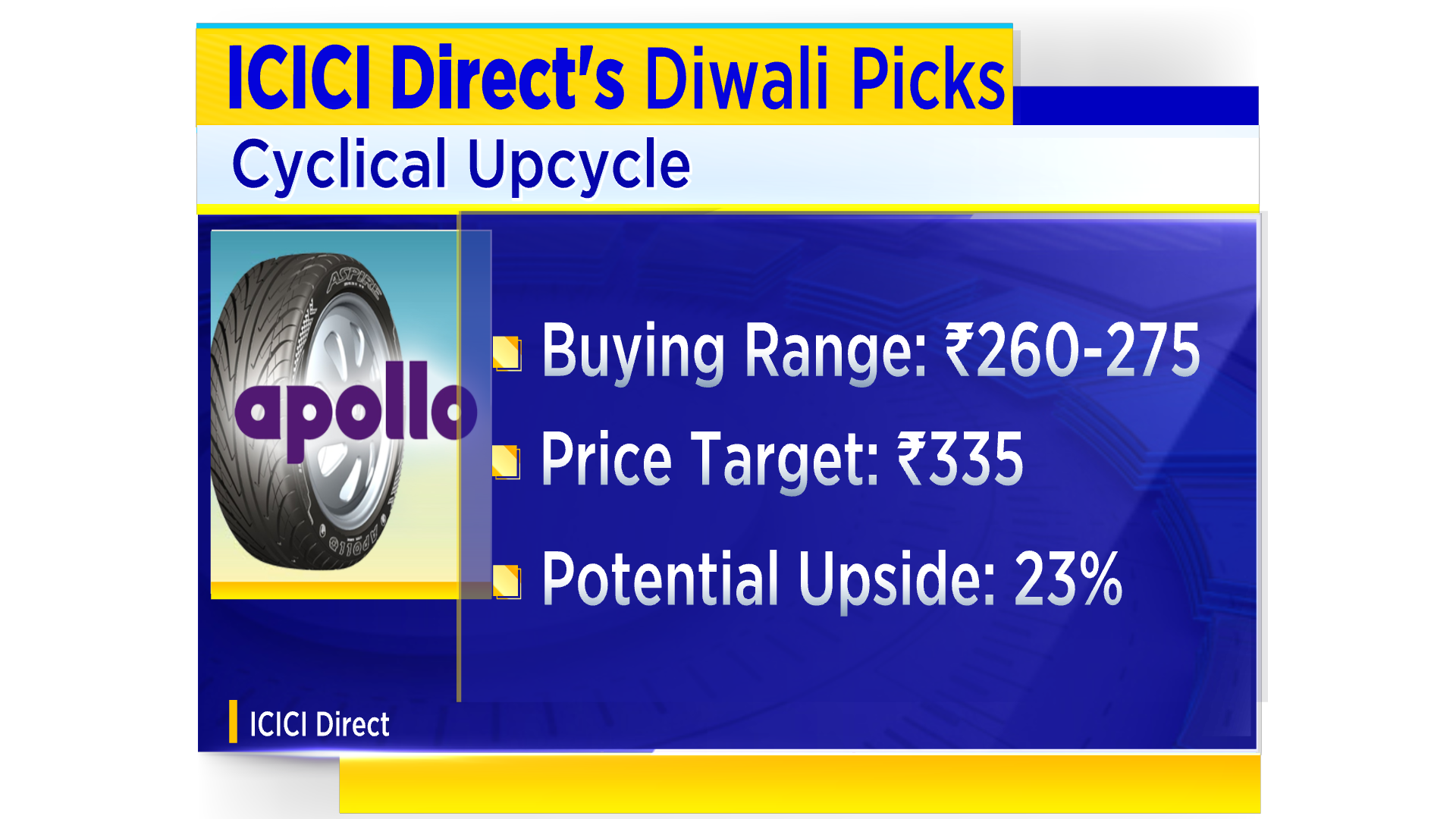

ICICI Direct expects Apollo Tires to benefit from a cyclical upturn in commercial and private vehicle sales. Restructured European operations now consistently generate high double-digit margins. The brokerage also expects the company to be one of the main beneficiaries of a correction in commodity prices such as natural rubber and crude. He believes Apollo Tires valuations are inexpensive given its $5 billion revenue target and debt reduction plans.

The brokerage expects Royal Enfield’s sales volumes to grow at a compound rate of 25% over the next two financial years. Amid high double-digit growth prospects, the company is trading at cheap valuations, according to ICICI Direct. Other benefits working in its favor include shifting consumer preferences towards high-end motorcycles and a healthy response to the Hunter 350.

co-forged

ICICI Direct expects Coforge to experience revenue growth of 19.1% over the next two years. The 11 major contracts won during the 2022 financial year offer a momentum for growth in the short and medium term. The brokerage also expects the focus on offshoring to drive further expansion of the company’s margins.

The hotel chain is well positioned to capture market share in the unorganized space, according to ICICI Direct. He considers the company to be more operationally efficient with a leaner cost structure. With the adoption of more technology, the brokerage expects Lemon Tree’s operating margins to increase by 50% over the next year. “The favorable location of its properties in prime tourist and business districts supports prospects for revenue growth and reduces concentration risk,” the note said.

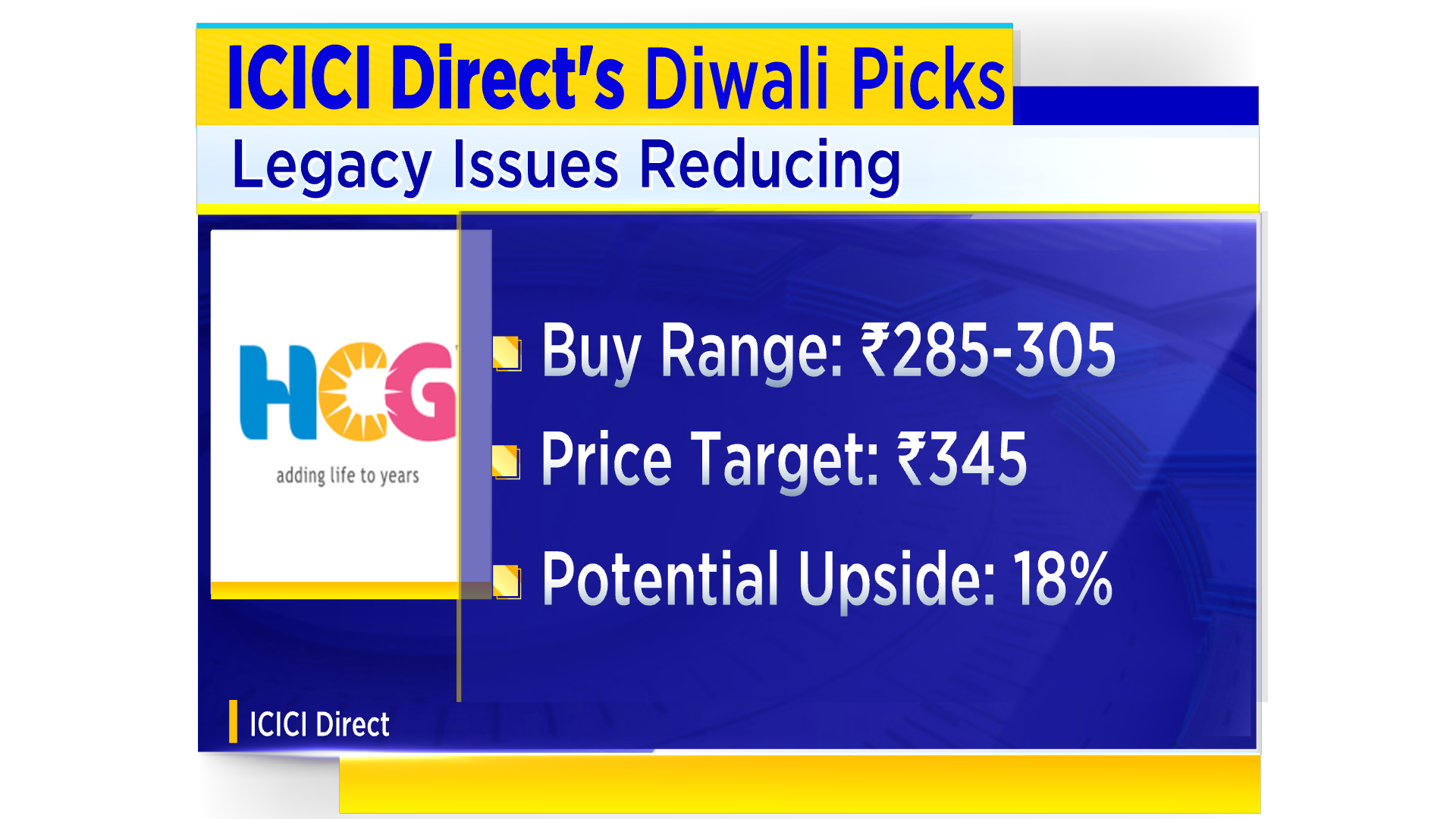

ICICI Direct believes that the surpluses inherited from the company are significantly reduced due to deleveraging of the balance sheet and reduction of losses in the new centers. It should benefit from the increase in oncology cases.

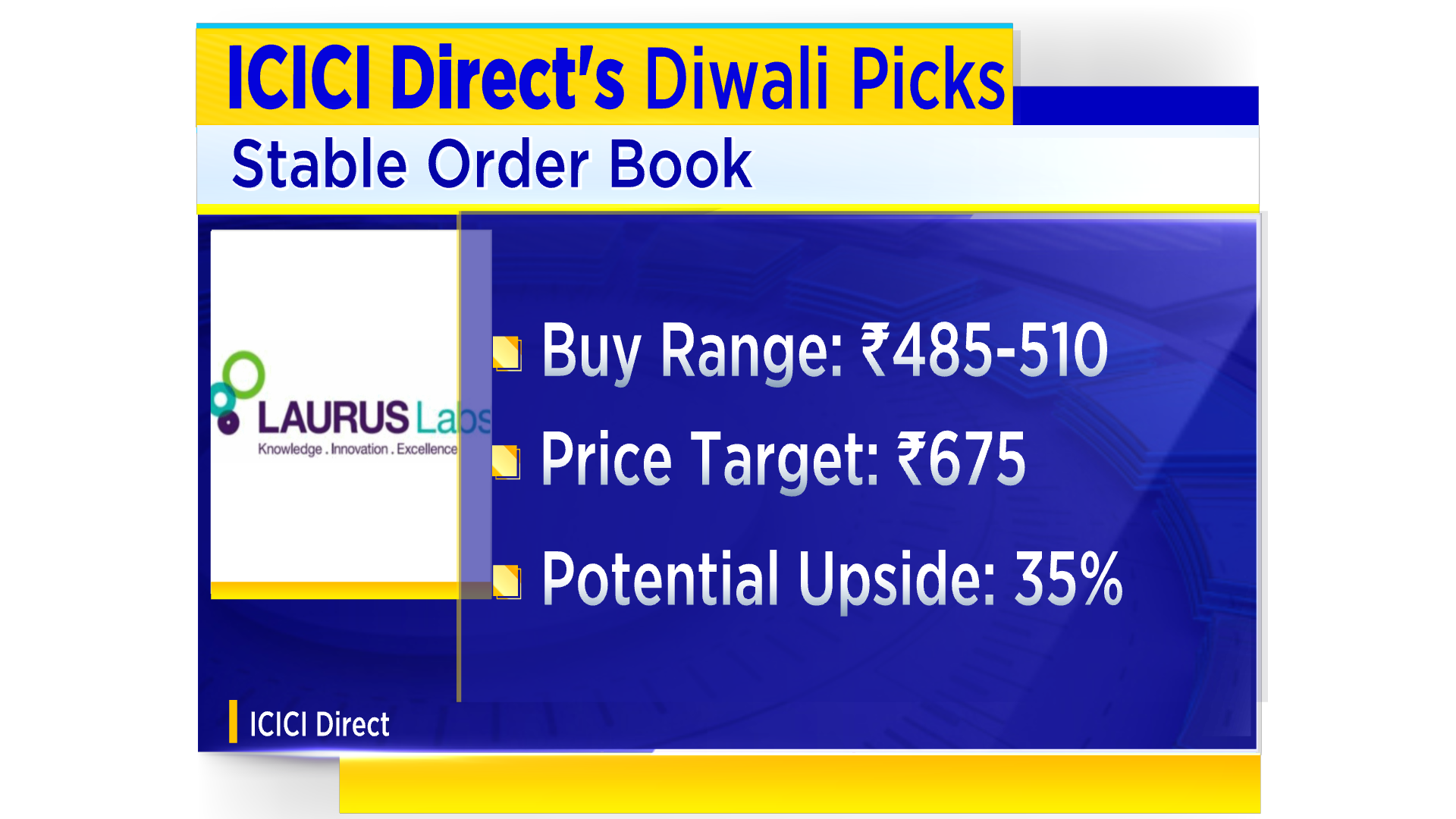

A stable API order book, product launches, capacity expansion are some of the key levers keeping ICICI Direct bullish on this stock. He expects the company’s formulations business to do well due to product launches in the antidiabetic portfolio in the US and Europe.

Driven by strong volume growth and incremental revenue from new initiatives, ICICI Direct expects Concor to achieve compound revenue and profit growth of 22% and 46% respectively over the next two years. Trading at reasonable valuations, the stock is expected to be one of the main beneficiaries of the shift in freight volume from road to rail, as envisaged by the National Logistics Policy.

ICICI Direct expects Havells to achieve a compound revenue growth rate of 16% over the next two years, driven by new product launches and reseller expansion. It also sees lower commodity prices and the launch of premium products to help margins recover. The brokerage sees Havells as an attractive stock in the FMEG space due to a strong brand, strong balance sheet and focus on improving profitability in the Lloyds business.