European stocks rose on Wednesday, with London hitting a new record, buoyed by hopes of lower interest rates as inflation slows.

Stocks on Wall Street faltered, however, as the rally from expectations of rate cuts faltered, while oil prices rebounded.

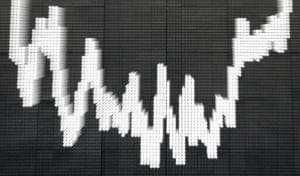

London’s FTSE 100 index hit an all-time high of 8,364.04 points on the eve of a monetary policy decision by the Bank of England, which is expected to maintain rates but could signal a cut this summer.

Stocks in Frankfurt and Paris also rose, shrugging off Asian losses, boosted by speculation that the European Central Bank may also decide to cut rates soon.

Sweden’s central bank on Wednesday cut its benchmark interest rate for the first time in eight years, citing slowing inflation and hinting at two more cuts before the end of the year.

The move comes nearly two months after the Swiss National Bank became the first major Western central bank to cut rates following a cycle of hikes in Europe and the United States, aimed at taming rising prices. consumption caused by the Russian invasion of Ukraine and the economic crisis. rebound after the Covid-19 pandemic.

The U.S. Federal Reserve, however, is not expected to cut rates until September as inflation remains stubbornly high in the world’s largest economy.

– Optimism –

“European stocks are rising on optimism that borrowing costs will soon fall,” City Index analyst Fiona Cincotta told AFP, noting that Frankfurt’s DAX was also close to its record high.

“The BoE is expected to leave rates unchanged but could start to pave the way for a rate cut in the coming months.”

The prospect of lower interest rates tends to boost stock markets because it reduces borrowing costs for individuals and businesses, thereby increasing both consumer spending and investment.

“A lower interest rate environment is good news for households and businesses alike,” Cincotta concluded.

Sterling fell against the dollar and the euro on expectations of a rate cut, which also boosted London stocks by making British stocks cheaper for foreign investors.

In Asia, major markets fell as dealers paused to catch their breath, with Hong Kong falling for the second day in a row after a 10-day winning streak.

Oil prices rebounded as Israel bombed Rafah and carried out raids in the southern Gaza city, while negotiations to end the seven-month war resumed in Cairo.

– Key figures around 3:30 p.m. GMT –

New York – Dow Jones: UP 0.2 percent to 38,958.62 points

New York – S&P 500: DOWN less than 0.1 percent to 5,184.07

New York – Dow Jones: Nasdaq Composite: DOWN 0.2 percent to 16,296.33

London – FTSE 100: UP 0.5 percent to 8,354.05 (closing)

Paris – CAC 40: UP 0.7% to 8,131.41 (closing)

Frankfurt – DAX: UP 0.4% to 18,498.38 (closing)

EURO STOXX 50: UP 0.5% to 5,038.17 (closing)

Tokyo – Nikkei 225: DOWN 1.6 percent to 38,202.37 (closing)

Hong Kong – Hang Seng Index: DOWN 0.9% to 18,313.86 (closing)

Shanghai – Composite: DOWN 0.6 percent to 3,128.48 (closing)

Euro/dollar: DOWN to $1.0748 from $1.0772 on Tuesday

Pound/dollar: DOWN to $1.2496 from $1.2564

Dollar/yen: UP to 155.56 yen from 153.86 yen

Euro/pound: UP to 86.03 from 85.72 pence

West Texas Intermediate: up 0.6% to $78.85 per barrel

North Sea Brent: up 0.4% to $83.53 per barrel

strawberries-rl/gv

FOX41 Yakima©FOX11 TriCities©

[ad_2]