The docile bond market of the past 20 years is gone. As much professional managers, dispatchers and advisers were burned last year, we expected underperformance but are now capitalizing on higher returns. While the risks on rates and credit spreads remain, the possibility of scaling the capital structure (i.e. lower risk) to achieve an almost equivalent income return (i.e. i.e. equity to debt, hybrid AT1 to Tier 2 bond, senior to hedged) is a clear sign to accumulate in a misunderstood and underappreciated local asset class.

The big giants and our sovereign wealth funds are rapidly increasing their bond allocations, investors should give this serious thought as well.

Hell has no fury like the despised bond market

Bond vigilantes have emerged from deep hibernation, forcing UK bonds, also known as Gilts, to yield levels not seen since the GFC. The The 2-year gilt is up +175 basis points in the last five days (all item data as of 10am September 27, 2022, unless otherwise noted). This is an unparalleled upward movement, which dates back to 1992. The 2-year gilt is now down 4.5%, at the start of the year it was 0.4%.

Additionally, the British Pound fell to an all-time low against the Dollar (latest: GBPUSD 1.077). These movements were prompted by the dilemma facing policymakers: stimulating growth through fiscal expansion but risking entrenching inflation; or let growth collapse, unemployment rise and inflation deflate. Britain’s new government has revealed a huge stimulus package to spur growth, a noble bet, but a foolish one in our view, given that the Bank of England expects inflation to continue to rise to 11% in October this year.

These moves, in addition to the Fed’s decisions last week, have seen our local bond yields rise accordingly. Since this morning (27/9/22) our 3mBBSW2 years and 10 years are respectively 3.02%, 3.53% and 4.05%. The AusBond Composite IndexAPRA’s local fixed income benchmark for superannuation is now -1.89% since the beginning of the month (mtd, as of 9/26/22) and -10.52% since the beginning of the year (YTD).

Credit where it’s due

The biggest credit story currently is the buyout and associated financing of Citrix systems (NASDAQ: CTXS), where banks lost about US$600 million guaranteeing the deal. The majority of these losses were associated with the US$4 billion secured bond portion of the funding program. The bonds were eventually priced at a yield of about 10% and a discount in price of about 84 cents on the dollar.

When simplified, it is common in the US leveraged buyout (LBO) market for banks to commit funding to private equity sponsors in the months before a deal closes. Once finalized, banks then offload these commitments into the loan and bond market. If prices move in the wrong direction, banks are forced to offer price discounts to attract investors.

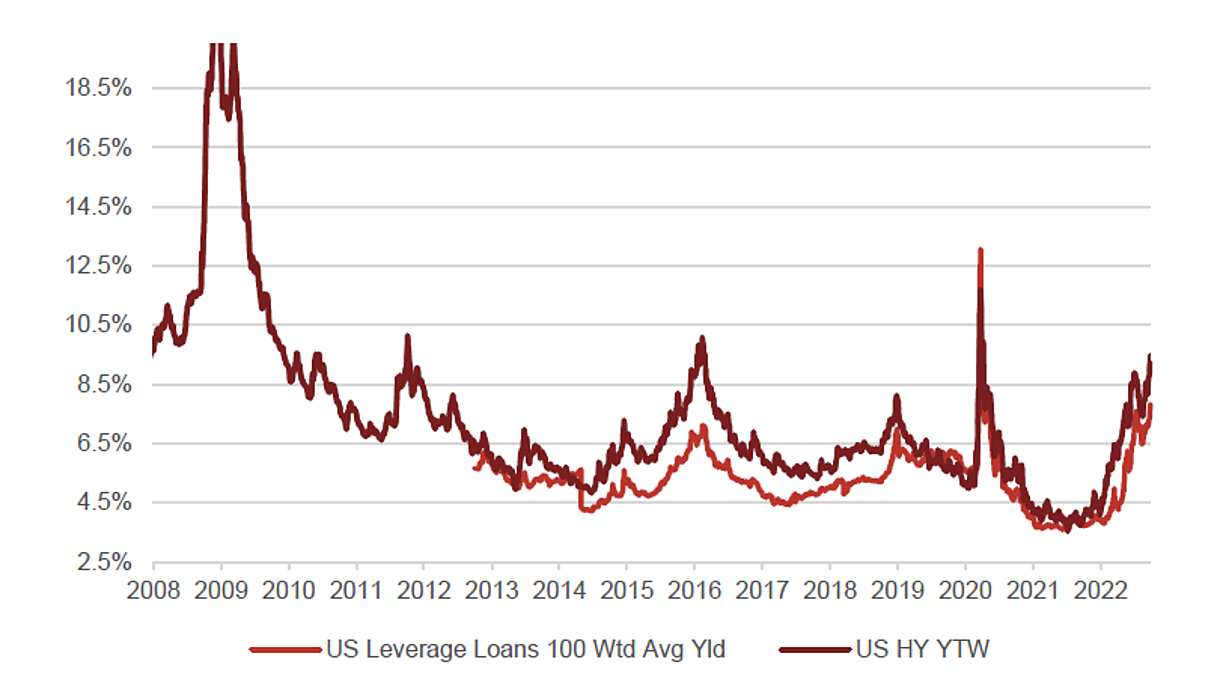

Those with longer memories will remember the big losses that banks were forced to incur in the GFC under such circumstances. As Figure 2 illustrates, funding costs have shown no real relief this year in high yield. Other losses on financing agreements with banks this year include Interband and Entered totaling $85 million.

The main finding is that higher funding costs put increased pressure on banks seeking to unload their liabilities. This casts an ominous shadow over the LBO market and will ultimately lead to greater volatility in high yield credit spreads between loans and bonds.

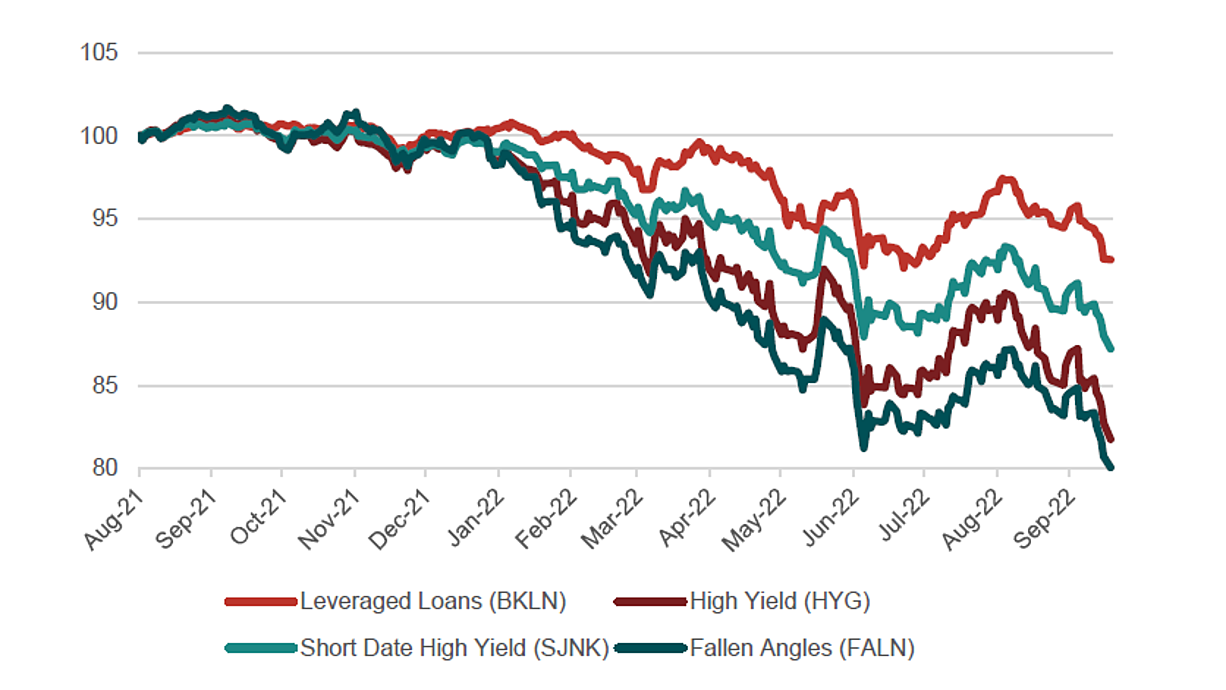

The challenging issuance environment, where U.S. and European CCC bond yields have exceeded 10% since May (see Figure 3) – a separate measure of stress, is compounded by an outflow of mutual fund redemptions and ‘ETF due to weak performance (see Figure 4) and cross asset rebalancing.

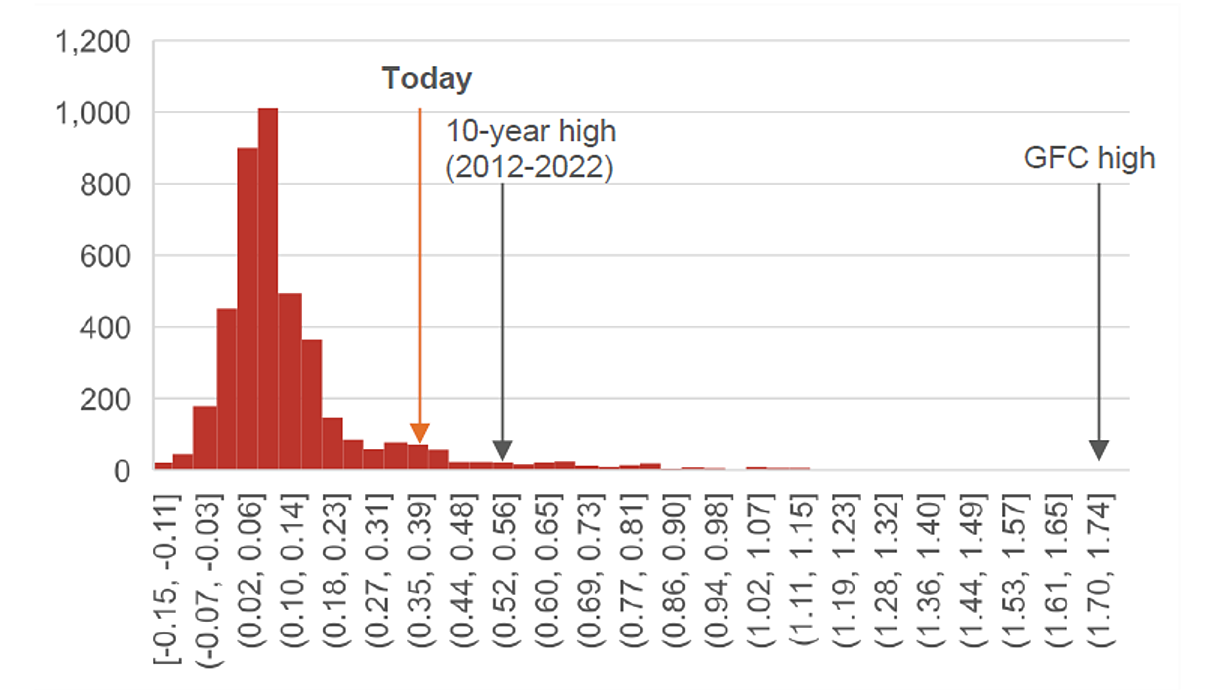

Taking a brief tangent to funding stress, the TED spread, which we discussed here, has risen sharply over the past week to approach the highs seen earlier this year. As shown in Figure 5, as we leapfrog away from GFC levels, it conjures up other funding and liquidity anecdotes that come increasingly to mind. A local example here is ZipCo (ASX: ZIP), which yesterday brought to the securitization market a 13-month Master Trust ABS, whose A1 tranche (AAA credit rating) had a price orientation of +195 basis points, the A2 tranche (also a AAA credit rating) had a price guidance of +315 basis points and the F tranche, with a B credit rating, had a price guidance of +1,250 basis points. At these prices, we’re starting to wonder when the equity financing model is collapsing here – and if it’s just a transfer of risk.

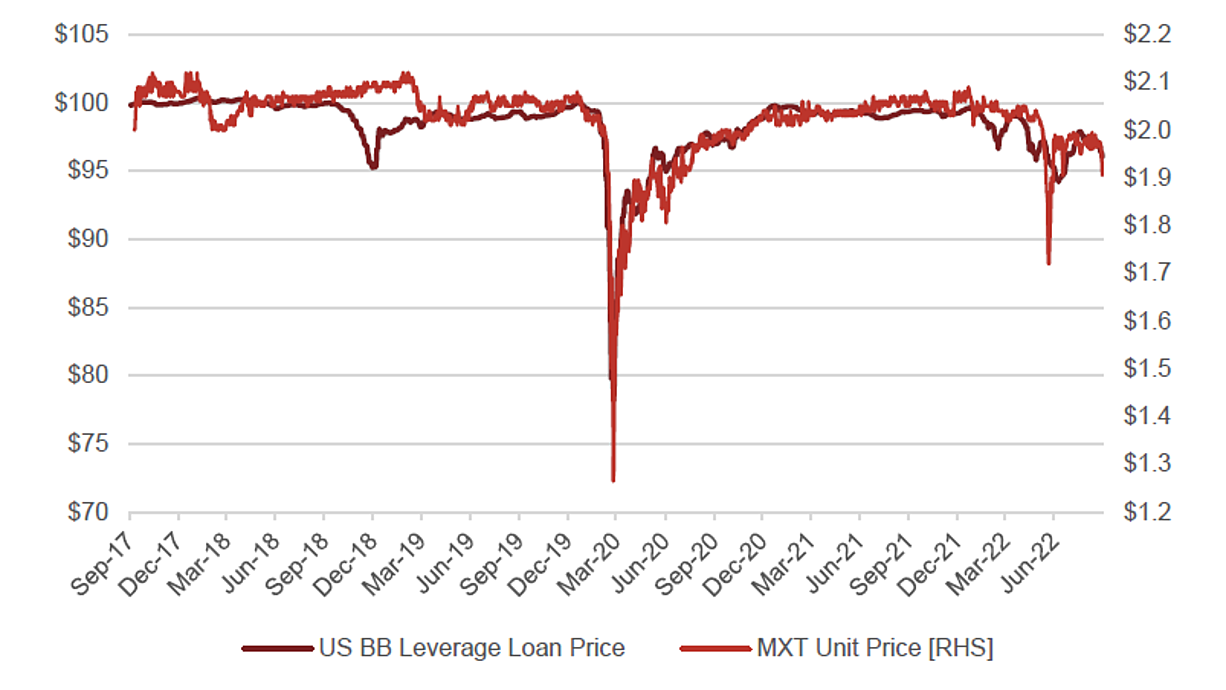

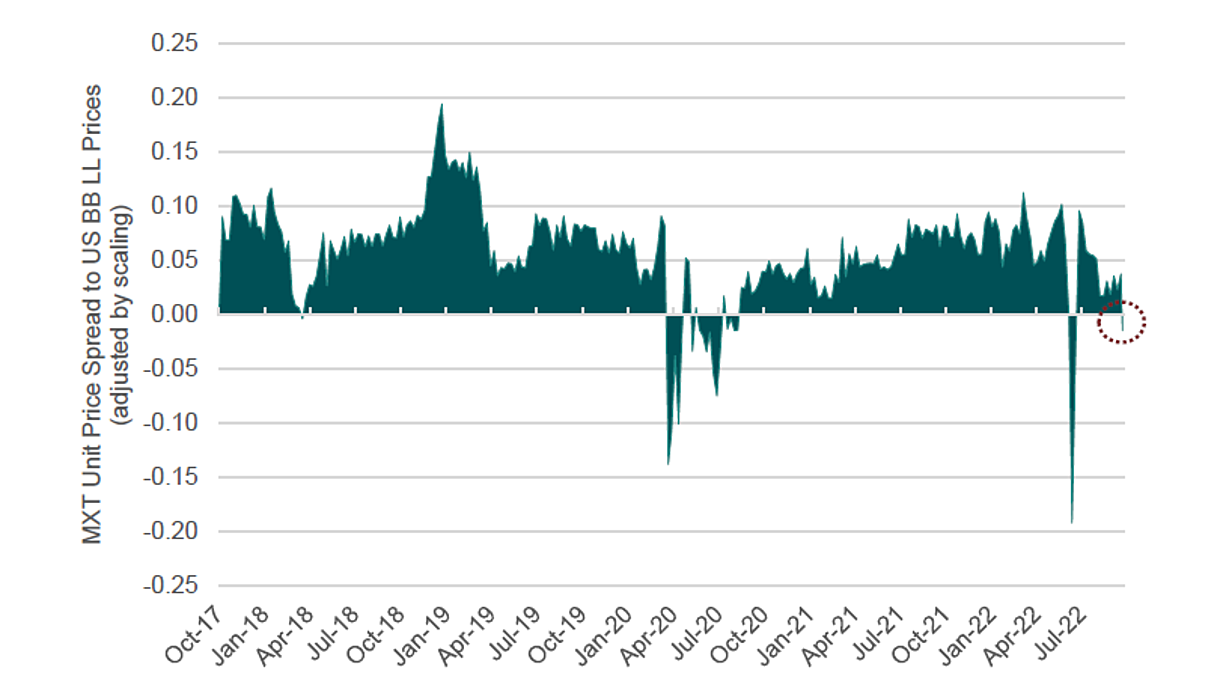

Offshore loan prices saw their biggest drop in nearly three months on Friday and Principal Income Trust Metrics (ASX:MXT) also saw its biggest price drop in three months yesterday (notably, the net asset value did not fall on a clean basis). This prompted us to compare the traded unit price of MXT to the US loan market on a price basis. While there are several structural reasons why such a comparison is not apples-to-apples (dirty versus clean, different legal frameworks for creditors, different underlying exposures, different warranties and covenants), we note that since September 2019, there has been a strong relationship here.

We believe that this relationship lacks fundamental merit; it is nevertheless a negotiated dynamic which is somewhat understandable given the proxy-like nature. Indeed, as illustrated in Figure 7, the relationship, when scaled to adjust for different prices, provides a powerful tool to assess value and therefore a signal to buy and sell.

While this signal is similar to a pure comparison to MXT’s net asset value, it provides a traded market overlay, which we consider useful from an opportunity cost perspective. We note that this relationship turned negative yesterday, indicating relative levels of cheap (albeit moderate).

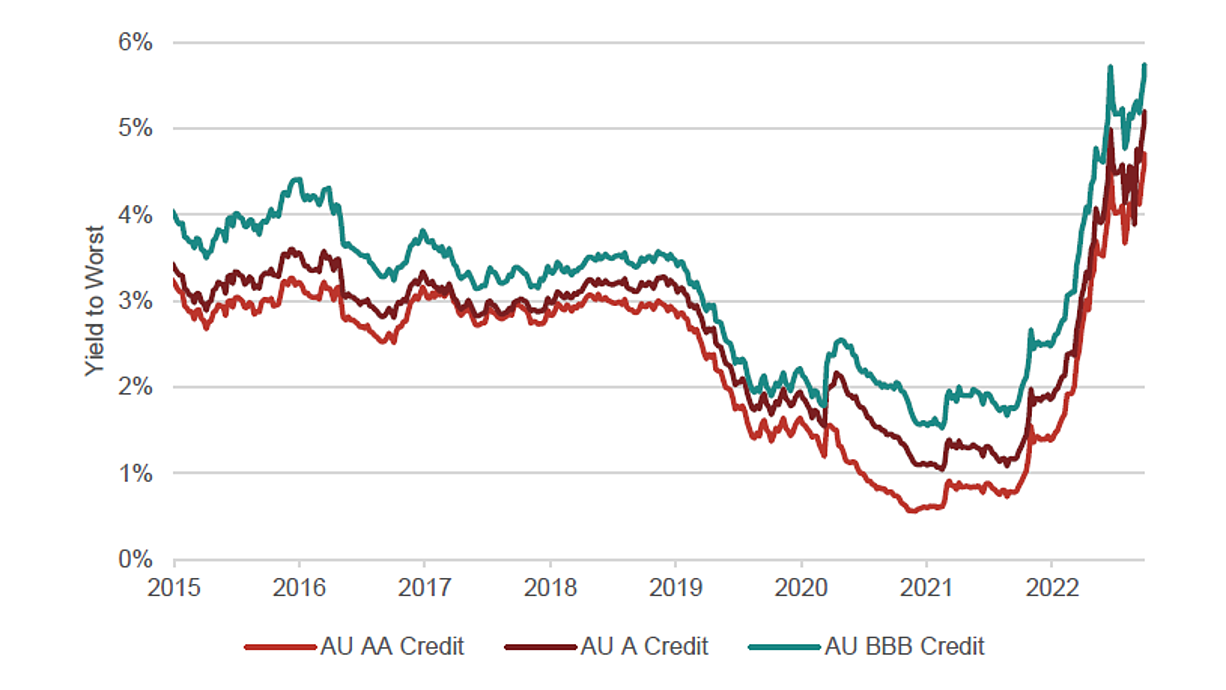

Locally, our business credit financing costs are back to 5-year highs. Spreads have moderated, particularly in financials, meaning that the driver of higher funding costs has been rising risk-free rates. Such levels for investors now get too cheap to ignoreespecially compared to an ASX200 dividend yield of 5.08% – effectively the same as an investment grade bond yield – but for far less volatility and market risk.

This point is underlined by Figure 9, which illustrates that compensation for interest rate risk is at levels not seen in the previous 5 years. As an indication, the AusBond Credit 1-5 year index posted a return of 5.01% with a modified duration of 2.76. For those with more aggressive duration mandates, the 5-7 year index returns 5.7% for a modified duration of 5.13. More importantly, for those who don’t want duration or interest rate risk, the AusBond Credit Floating Rate Note Index yields 4.59%.

Bonds are back. Fear creates opportunities for informed people, which has not been the case for decades.