Historically, the bond market has been quite old-fashioned compared to stocks. Email is still considered quite modern, and if you want to make a big trade, you still have to pick up the phone. Ugh.

The post-financial crisis era has made things even trickier. Banks have been forced to close their massive prop desks and limit the amount of inventory their market-making desks can hold. Complaints and concerns about the implications for bond market liquidity have been rampant over the past decade.

However, things are changing fast – faster even than many traders thought just a few years ago.

The advent of better pricing algorithms and the explosion of exchange-traded funds have led to a boom in “portfolio trading” in bond markets, through which banks and investment groups can quickly and efficiently move baskets multi-billion dollar fixed income securities with scores, perhaps even hundreds of individual bonds at one time.

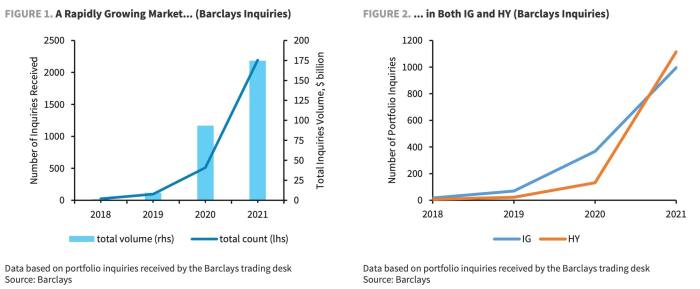

A report from Barclays has just landed in FT Alphaville’s inbox which highlights just how important this has become. Barclays credit analysts have analyzed the numbers for the portfolio trading phenomenon and estimate that it now accounts for 8% of ALL fixed income transactions in the US, up from virtually zero before 2018.

Portfolio trading volumes now average almost $40 billion per month between investment grade and high yield bonds, Barclays estimates, based on their own data (more than 2,000 requests and $175 billion dollars in volume last year) and browsing TRACE for similar patterns in the public. – reported bond transactions.

Just to hammer it again, This Is A Very Big Deal. Eight percent of all US bond transactions is already a pretty significant number, and it continues to rise.

People have of course been able to buy and sell a lot of bond market risk in the past, but mostly through credit index total return swaps or credit default swap indices like CDX. But it was often expensive, exposures were often sub-optimal, and not all investors could use derivatives.

If you had the time and were feeling brave, you could also send a bank a long list of bonds you wanted to unload, and ask for a price for the set and pray your face wouldn’t get ripped off once that he would have calculated the “right”. ” value of each component and of the portfolio as a whole.

But the advent and growth of bond ETFs – now around $1.7 billion and heading towards $5 billion by 2030 according to BlackRock – coupled with investments in algorithmic pricing models and e-commerce have unlocked a lot more options and are starting to reshape the whole ecosystem. It’s not even your older brother’s market anymore.

Fixed income is now in one of those classic flywheels loved by advisory firms, where more electronic trading breeds more adoption, liquidity and innovation, and in turn even more trading electronic.

While fixed income will never look exactly like stocks, the growth of phenomena such as portfolio trading shows how it is evolving to become much closer than many thought a decade ago.

Of course, this is going to lead to a whole other set of problems, as we saw with the advent of fully electronic stock trading 20 to 30 years ago. . .

Further reading:

Bond trading: Tech is finally disrupting a $50,000,000,000 market — FT

ETFs are starting to reshape bond trading — FT

The new kings of the bond market — FT

The next quantitative revolution: Shaking up the corporate bond market — FT