September 29, Bitcoin Magazine Analyst Dylan LeClair noted that Bitcoin had begun to “decouple” from the S&P 500.

His charts below show the difference between the two widening as the S&P 500 continues to slide amid macroeconomic weakness highlighted by the Bank of England’s (BoE) pivot to quantitative easing this week.

Due to its fixed supply of 21 million tokens, Bitcoin has always been sold as “anti-fiat” that could not be reduced to zero.

As the global economy continues to falter, this narrative unfolded as BTC exhibited risky characteristics. However, recent BTC performance may suggest otherwise.

Is Bitcoin Legacy Hedge?

In April, Bloomberg published an article showing the correlation between Bitcoin and the S&P 500 at an all-time high. This discussion further derailed about BTC being a “safe haven asset”.

Inflation has since worsened and ordinary people are directly feeling the effects of accommodative monetary policy in a cost of living crisis.

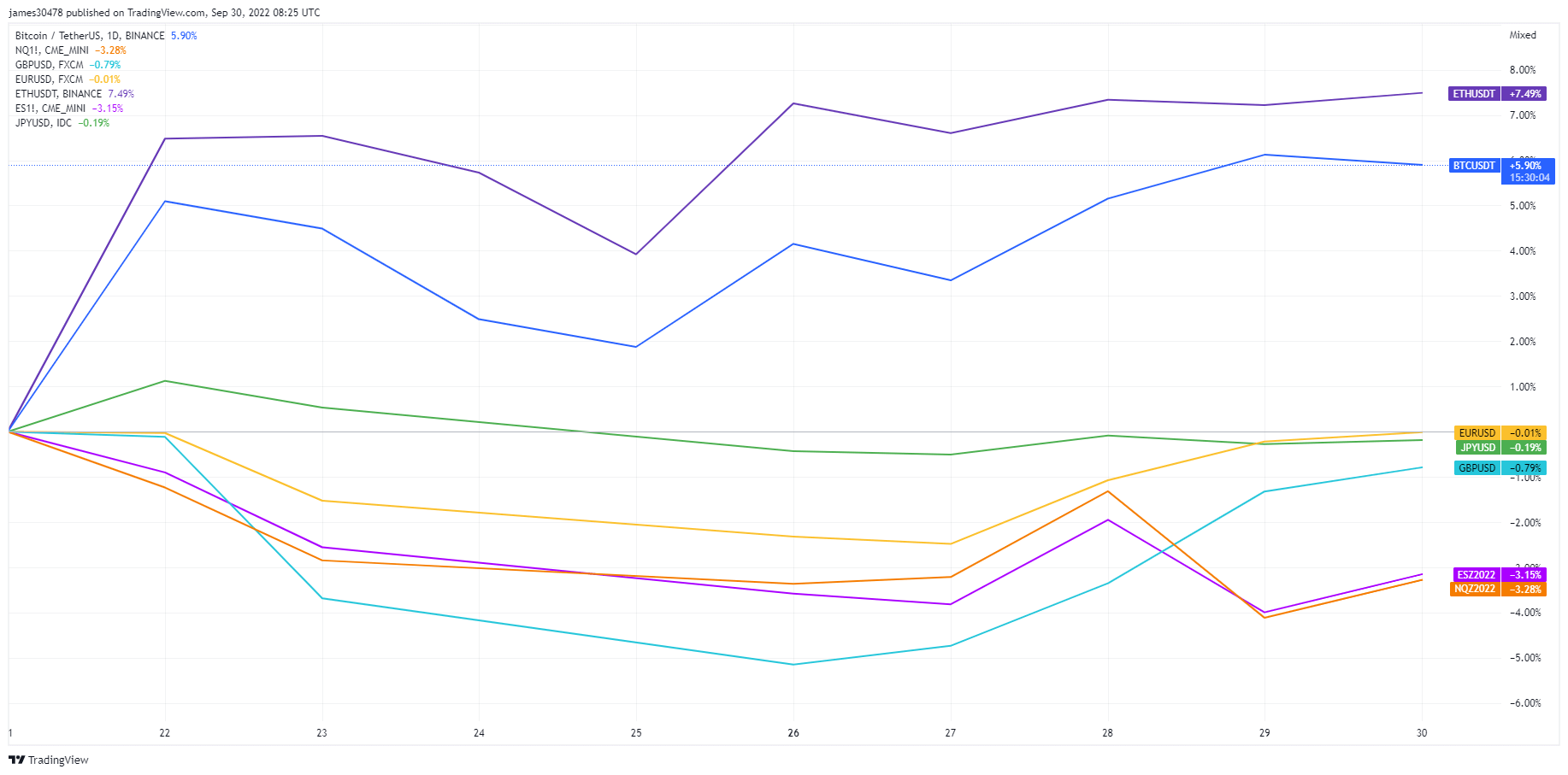

As risky assets continue to fall, Bitcoin has remained stable, trading between $18,100 and $22,800 throughout September.

Meanwhile, the S&P500 has seen a sharp decline over the same period, falling 10% since Sept. 1 — a significant percentage decline for a legacy index.

Since the September 21 FOMC meeting, in which the Fed implemented a third consecutive 75 basis point rate hike, BTC and ETH have outperformed major currencies other than the USD, providing a additional evidence of decoupling.

LeClair doubts decoupling will continue

The question remains, will this trend persist as the macro landscape continues to deteriorate?

LeClair responded by saying that a continuation of this trend is “highly unlikely”. Still, BTC’s recent outperformance is a “decent start” to restoring its safe-haven narrative.

“I still think a long-lasting ‘decoupling’ is highly unlikely at this point, but the relative outperformance is a good start.“

Thereupon he signed saying that it was “aTake a look at currencies, global bonds and stocks” as investors prepare for what lies ahead.

In the near term, some analysts predict that other central banks will follow the BoE and reverse hawkish policies to intervene in future crises.