In April 2019, South Korean carriers took the lead in 5G launch and achieved first-mover success. LG U+, for example, has reported year-over-year growth in wireless service revenue for 13 consecutive quarters, reversing the slowdown seen before 2018. The carrier’s financial reports reveal that its service revenue wireless grew by 14% in the first quarter of 2022 compared to 2019 Q1, shortly before the commercial launch of 5G.

The Korean model is difficult to replicate?

South Korea’s 5G development model is often seen as difficult to replicate for two main reasons.

- First, for network deployment, it appears that South Korean carriers have invested heavily in achieving rapid nationwide coverage, regardless of peak CAPEX. This is not how most carriers approach network deployment.

- Second, because South Korean operators are part of a large conglomerate, they can operate internal content platforms and invest heavily in original content. This is out of reach for many carriers.

Let’s take LG U+ as an example of a carrier that has adopted the “invest early” strategy:

- Early launch: At the start of LTE, LG U+ managed to launch LTE about 6 months earlier than KT, which helped it attract the most LTE subscribers in the first few months and increase its overall market share .

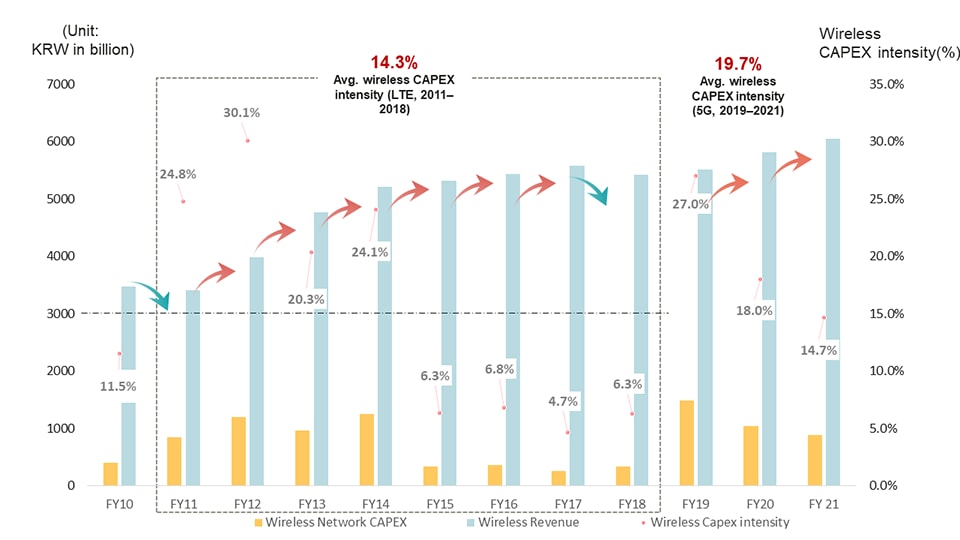

Figure 1: LG U+ took the lead in LTE launch in Q3 2011 (Source: LG U+ Financial Reports 2012Q3)

- Early execution: As shown in Figure 2, despite LG U+’s rather high wireless CAPEX intensity (20% – 30%) in the first four years of LTE, this number dropped to 14.3% when looking at the average intensity over the LTE period from 2011 to 2018. – a modest figure compared to the global average CAPEX intensity of around 16%. With this strategy, anticipated investments in the first four years of LTE have led to seven years of continued wireless service revenue growth. Since 2019, 5G has driven a new wave of wireless service revenue growth.

Figure 2: LG U+ wireless CAPEX intensity and wireless service revenue over the past 10 years (Source: LG U+ financial reports from 2010 to 2021)

Note: Wireless CAPEX Intensity = Wireless CAPEX / Wireless Service Revenue

South Korea’s rapid nationwide coverage has also benefited from the country’s population distribution. South Korea ranks 24th in the world in terms of population density, according to the World Bank, with a large part of the population living in the Seoul Capital Region (nearly 50% of the population) and in the six largest metropolitan cities. The concentrated, high-density population allowed operators to quickly achieve nationwide coverage.

5G monetization

As the massive network rollout is underway, three monetization approaches have emerged that operators can begin immediately:

- Traffic monetization, as represented by Chinese carriers: 5G plans offer more data allowances at lower prices per GB for incremental ARPU. The underlying driver is the gap and growth margin between the average 4G DOU (~10GB) and the 5G DOU (>30GB).

- device upgrade, as represented by US carriers: people replace their phones on average every 3.2 years, which means that about 30% of mobile phones are replaced every year. When users replace their phones, carriers can use the opportunity to encourage them to upgrade to a 5G plan.

- Content and Service, as represented by South Korean carriers: South Korean carriers are using 5G services and content as one of the main drivers of 5G user migration.

Carriers often apply more than one of the approaches mentioned above. For example, carriers in South Korea are also using device upgrades, while carriers in China are also investing in content and services.

1. Traffic monetization

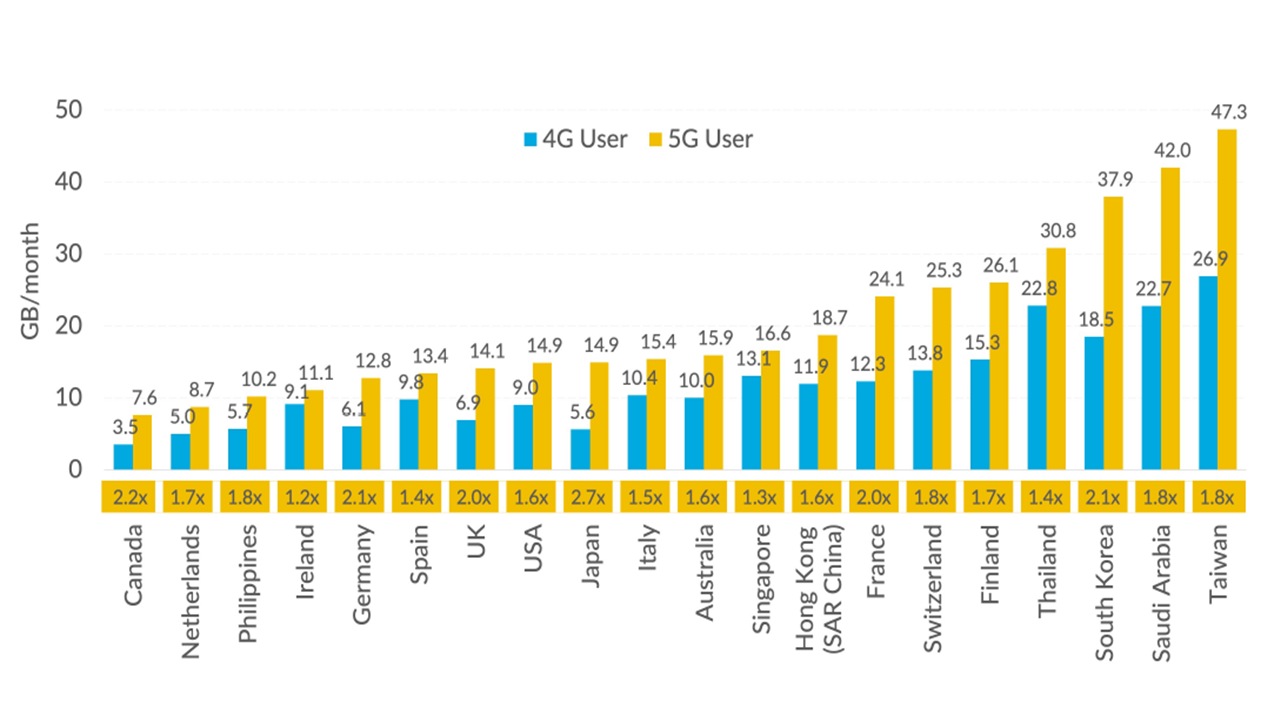

In most 5G markets, 5G carries a significantly higher DOU than 4G (Figure 3). Increased traffic is what 5G carriers can immediately monetize.

Figure 3: 5G users consume twice as much data as 4G users (Source: OpenSignal, June 2021)

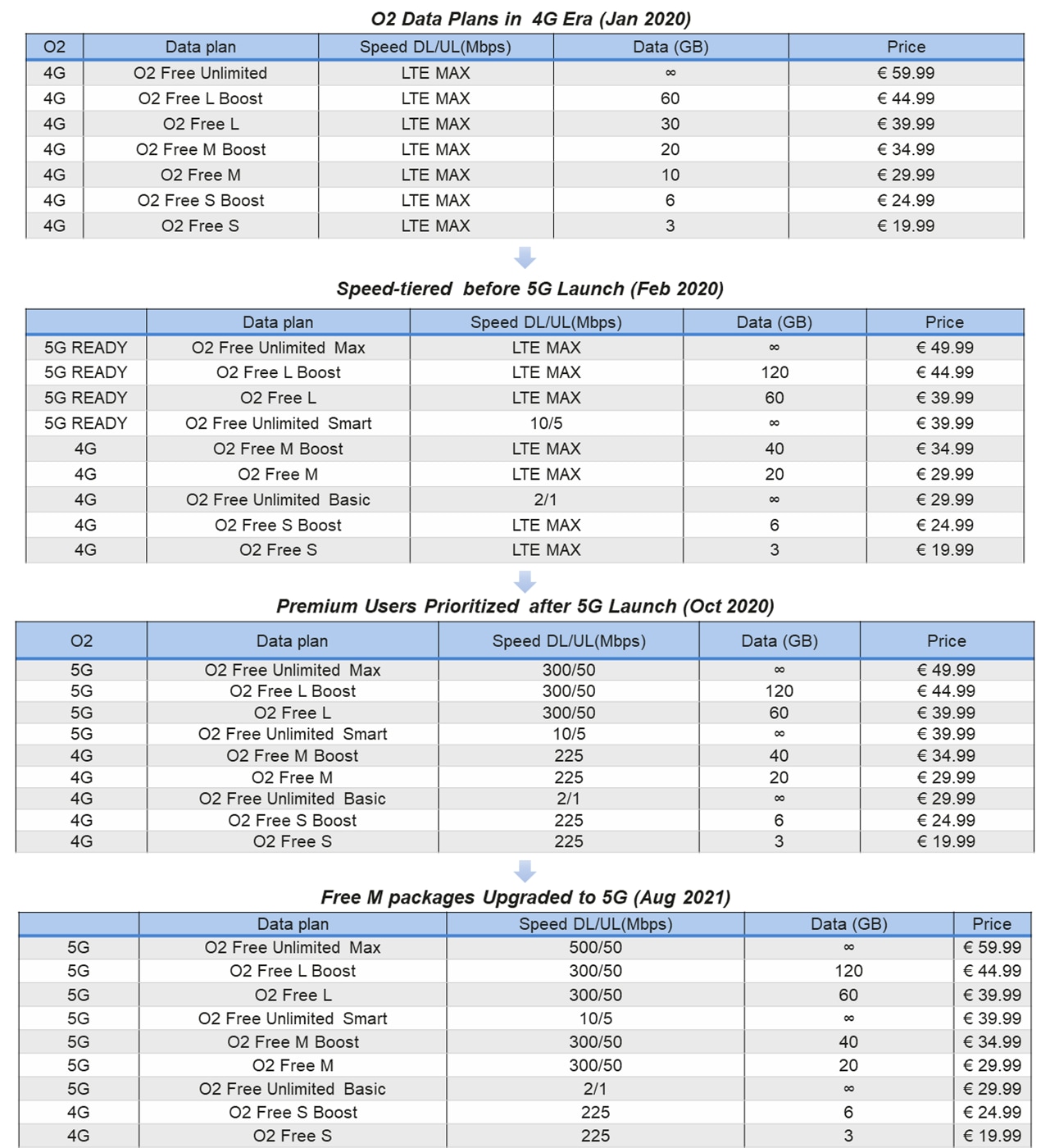

O2 Germany, operating in a market where average monthly mobile data usage is rather low in Europe, is using 5G as an opportunity to increase and monetize traffic (see Figure 4).

- In February 2020, the carrier introduced 5G-ready plans with unchanged prices, but data allowances doubled. It also introduced unlimited data plans at multiple speed levels.

- In October 2020, O2 Germany launched 5G commercially, with 5G-ready packages becoming 5G.

- In August 2021, the carrier extended 5G plans to FREE M plans.

Figure 4: O2 Germany’s scalable packages that increase data traffic

In Q3 2021, O2 Germany’s monthly postpaid user DOU reached 11 GB, the highest in the market, indicating preliminary success of the carrier’s goal to increase traffic.

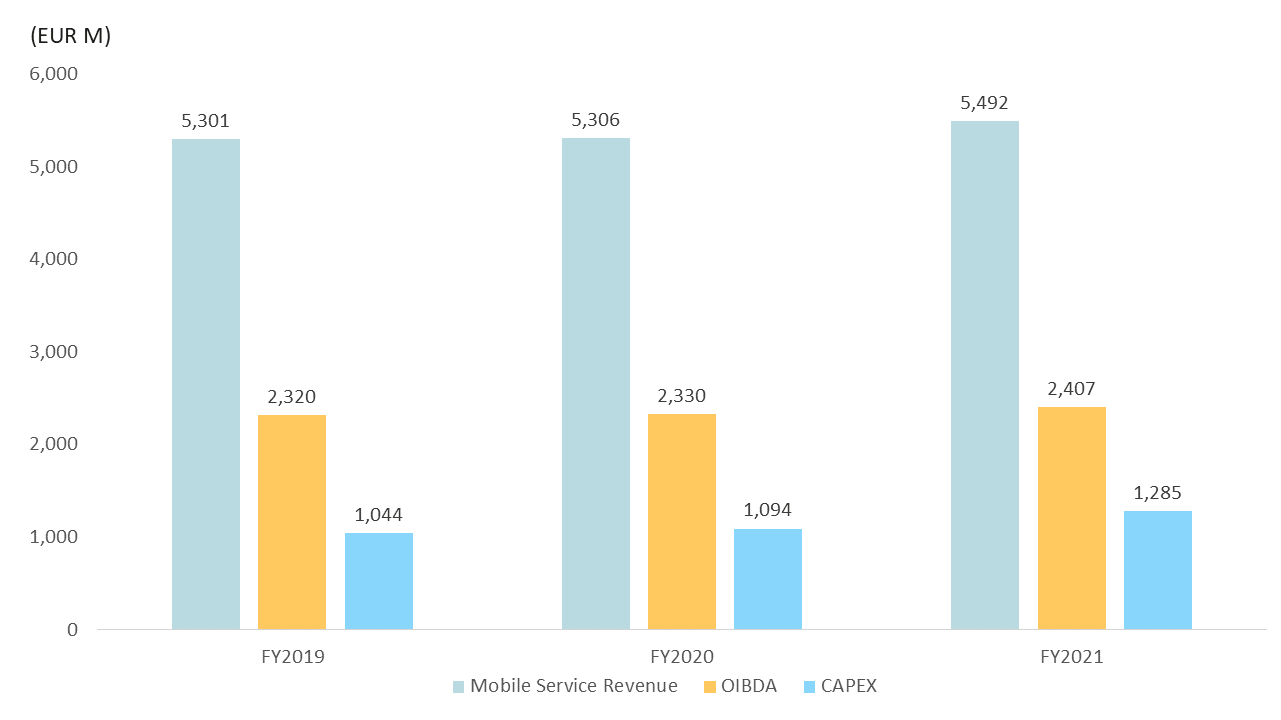

To better support user traffic growth in the 5G era, O2 Germany has executed an exceptional program of “investments for growth”, beginning a virtuous cycle of increasing traffic, increasing revenue and growing. accelerating network deployment.

Figure 5: Revenue growth of O2 Germany mobile services, OIBDA and CAPEX over the last three years (Source: O2 Germany financial report in 2019, 2020 and 2021)

Note: OIBDA (Operating Income Before Depreciation & Amortization) and CAPEX are both aggregate numbers.

2. Device Upgrade

In November 2021, the CEO of T-Mobile US hailed the 5G smartphone as the first killer 5G app[1]supported by the dominance of US carriers in smartphone distribution and the window of opportunity to tie users to premium 5G plans using smartphone subsidies.

AT&T, for example, offered a $1,000 subsidy (the price of the iPhone 13 Pro) to replace many older handset models on the condition that users sign up for its unlimited premium plan. The replacement and upgrade program was largely driven by the iPhone 12 halo effect and user intent surveys.

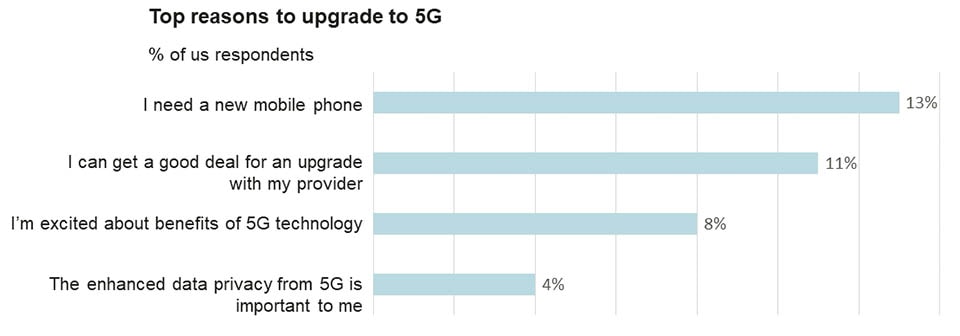

In the US market, carriers are the main distribution channel for smartphones, with Apple occupying more than 60% of the smartphone market. Apple’s first 5G phone, the iPhone 12, propelled the 5G “supercycle”. In addition, new mobile phones are the main driver for American Internet users to switch to 5G (Figure 6). Ten percent of cellphone users replace their phone within 12 months and 24% do so within 18 months. They represent the key target of the first users of the 5G migration.

Figure 6: Top reasons for US users to switch to 5G (Source: YouGov, June 2021)

This wave of device upgrades has led to a rapid increase in the number of 5G users for the three major US carriers. By the end of 2021, the total number of 5G users in the United States exceeded 50 million[2]. Today, smartphone subsidization remains a common practice in many markets where carriers are one of the main sales channels for smartphones. However, it is important to note that while subsidies may be tempting, the real foundation is still the 5G network experience. That’s why U.S. carriers are scrambling to fill the gaps by bidding for C-band and investing in C-band networks.[3].

3. Content and Services

5G offers need to be tangible to encourage user migration to 5G, and that’s why 5G content and services are needed. Additionally, 5G content and services contribute to ARPU, as the price of data traffic decreases every year.

In the context of South Korea’s strategy to become a major exporter of popular culture[4], South Korean carriers have been investing heavily and innovating in content and services since the days of 4G. While running their own video platforms, they have also invested significantly in content acquisition and production. LG U+’s mobile video strategy in the 4G era, for example, was considered a great success.

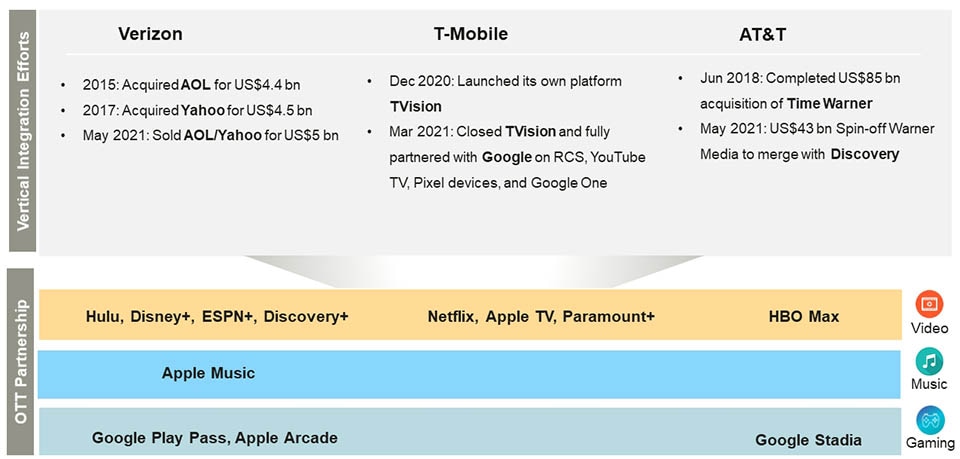

American carriers were once as ambitious in this area. AT&T acquired Time Warner and Verizon acquired AOL and Yahoo, forming Verizon Media. However, they have changed course and have now fully embraced OTT services.

Figure 7: Vertical integration and OTT cooperation of US operators

Obviously, self-management is not the only approach for carriers. Even South Korean carriers are also actively working with third-party service providers in 5G. LG U+ cloud gaming and kids AR services are based on Nvidia’s GeForce Now and Inception’s Bookful[5]respectively.

Figure 8: LG U+ works with Inception/Bookful on AR for Kids services

Carriers can also adopt the white label partnership model. For example, Sunrise from Switzerland works with a partner who provides gaming content and a cloud gaming platform (including software and hardware servers), while Sunrise focuses on marketing and operations. There are a number of routes to Rome to launch 5G services: operators can choose either the OTT (“EASY”) partnership model or the content production (“HARD”) model. Their specific choices depend on a few factors, including local market (eg, adoption of OTT services), organization, and expertise (eg, content teams), among others.

Figure 9: Different service introduction models for carriers

Key takeaways for operators

More than three years after the first commercial launch of 5G, major operators in East Asia, the Middle East and Europe have crossed the chasm and built a considerable 5G user base (~20% of penetration of 5G users). Carrier business performance metrics show that 5G user growth has increased ARPU, mobile services revenue and EBITDA margins. With accelerating global 5G adoption, carriers can start recruiting 5G users by providing more data allowances, higher speeds, and more offerings (5G content and services) without waiting for applications. say 5G killer, in order to achieve the first wave of growth.

The early successes of major 5G operators around the world have two implications for the commercial success of 5G. First, the 5G network experience remains the basis. Premium or 5G upgrades would not be possible or sustainable without compelling network speeds and coverage. Second, 5G content and services are essential. Carriers should choose appropriate pathways ranging from low-threshold models like third-party partnerships to higher-threshold models like participation in content production.