Sladic/E+ via Getty Images

Investment thesis

Apple (NASDAQ: AAPL) is ready for a sale. Not on its own initiative, but because the global economy is slowing down. I highlight examples of companies that describe how the near-term macroeconomic outlook has weakened more than expectations.

I then remind readers of the global cost of living crisis, leading us to turn the spotlight on Europe.

Then I explain how the Wall Street game is played and how to think about it as a passive shareholder.

Further, I emphasize that paying more than 20 times forward earnings for a company whose bottom line grows by almost 6% to 7% does not provide investors with a margin of safety.

Finally, this is not a hard sell item. But I hope I can give you some food for thought on the underlying issues facing Apple before it’s too late.

Businesses shed light on their outlook

Over the past few weeks, we’ve seen macro-conscious companies say things are slowing down. I’m not talking about the small shops making bearish calls to make a name for themselves.

I am referring to global companies that want to do everything in their power to ensure that their the stock remains in placebut must mitigate the carnage of their stock by getting ahead of the street.

For example, FedEx (FDX) recently noted that it had experienced macroeconomic weakness and was forced to withdraw its guidance for fiscal year 2023, stating,

Global volumes declined as macro trends deteriorated significantly later in the quarter, both internationally and in the US.

FedEx is an example of a company that has insight into global logistics and how things actually work on the ground.

Another company that has recently acknowledged that short-term things are tough is Nvidia (NVDA), noting at a conference that the company has witnessed a short-term supply glut.

We immediately took steps to also reprice pricing programs to move this inventory through.

The semis are a leading indicator of macro demand. Even if Nvidia notes that next year things will be better.

Next, Ford (F) outlines some of its supply chain issues as about 40,000 vehicles are running out of parts, forcing the company to revise down its forecast for the next quarter. Even though Ford felt it could brave it and hit its annual targets for the year.

Next, ArcelorMittal (MT) describes how low demand for steel as well as prohibitive energy costs in Europe caused the company to shut down some of its factories.

These are not sensational comments seeking to stir up controversy. I’m sure you’ll agree that the selection I’ve mentioned is broad and representative of the underlying reality that these different sectors face.

But what does this have to do with Apple?

Global cost of living crisis

Realistically, one way or another, the Fed has to cool the US economy. And I’m in no position to speak outside of my depth on whether or not the Fed has had a successful soft landing or not.

What I can easily see from the countless companies I follow is that demand is falling rapidly. There is sweetness everywhere. Even in unexpected places like ServiceNow (NOW) whose platform is used by 50% of the world’s Fortune 500 blue chips. ServiceNow customers are the blues of the blue chips, with the most financial resources. And yet, ServiceNow is seeing its sales cycles lengthen.

Then, Alphabet’s (GOOG)(GOOGL) advertising revenue is also impacted. As companies reduce their advertising spend given the uncertain outlook facing their business.

Meanwhile, consumers around the world are facing strong inflationary pressures as energy costs rise. And this is particularly felt in Europe.

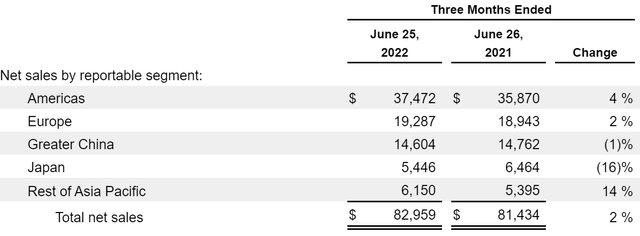

Apple’s 10-Q

As you can see above, Europe was until the last quarter a positive contributor to Apple’s revenue growth rates. And now, 22% of total revenue will curb Apple’s revenue.

Apple Stock – Don’t fall for the Wall Street game

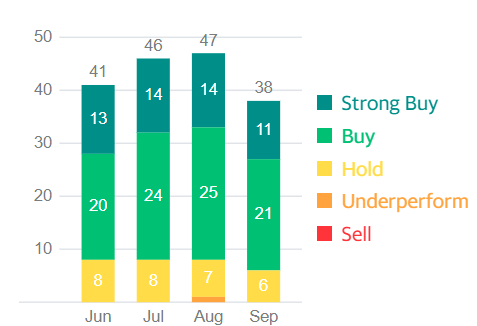

Second, most analysts who follow Apple have either a buy rating or a strong buy rating on the stock.

Yahoo! AAPL

This ensures that the analyst house has access to Apple executives in C-suits. And they are able to get a sense of the entire supply chain. Essentially, there are many indirect benefits to having a buy rating on Apple stock.

Having an underperforming rating on Apple stock is an indicator of a sell rating. And that opens no doors for analysts.

So when expectations are so high, where can the stock seriously go from here?

Apple is already priced at around 24 times forward earnings. There really is no way several can extend much furtherIn my opinion.

Indeed, even if Apple matches analysts’ expectations, you don’t get more than a 20x multiple on your revenue, when the company’s bottom line grows at a mid-single-digit CAGR.

No matter how good the business, no business lasts forever.

So what’s the takeaway here?

The easiest thing to do in investing is to say that everything will be fine and to relax and take comfort in knowing that you are a long-term investor. An investor who buys and holds forever.

After all, there is good reasons to stay with Apple. Especially since it is one of the few places in the market still relatively untouched by the bear market.

Also, let’s be honest. For many readers, they hear that the technology has been out of favor for over a year, and given that their stake in Apple has showed no weaknessthere is the belief that somehow Apple will pull through, as it has so far.

So what am I standing for? To sell all your Apple stock? Nope, that’s not what it’s about. I can’t predict how things will go for Apple. But I believe the chances of success from that point are slim.

Apple is the last general that still holds strong in this market. And with so many passive ETFs forced to buy Apple, that means the stock has managed to hold its own. Incidentally, note that 7% of all passive purchases of S&P500 ETFs are used to support Apple stock price.

And it worked extremely well for Apple holders. But the pieces of the puzzle are now coming together that will make Apple’s next few quarters fall short of expectations.

And when that happens, the stock will sell. And when the sale begins, a lot of institutions will want to hold on to their Apple gains, especially during the harvest. losses elsewhere in their portfolio.

The next group will then begin to rethink their own position. Indeed, while the stock price remains strong, no one is asking difficult questions about their investment. It’s only when things go wrong that investors ask the hard questions.

And then ETFs are also gaining momentum. So what’s my point? My point is the following, doing nothing is an active choice! And it may not be the best choice in this case. It’s OK to have a plan to sell some of your holdings. It’s not cheating. The stock doesn’t know or care that you own it.