radidia

Insight

Apple Inc. (NASDAQ: AAPL), probably the most iconic company in the world, has been a serial acquirer of companies for the past 5 or 6 years. On average, Apple acquired a new company every four weeks, with the majority of acquisitions being unrecognizable marks valued in the tens or hundreds of millions. One of Apple’s biggest acquisitions over the past decade has been Beats Electronics, the headphone maker founded by rapper and producer Dr. Dre, for $3 billion. Apart from that, Apple usually acquires small companies for their technology and talent and then incorporates said technology into its own products.

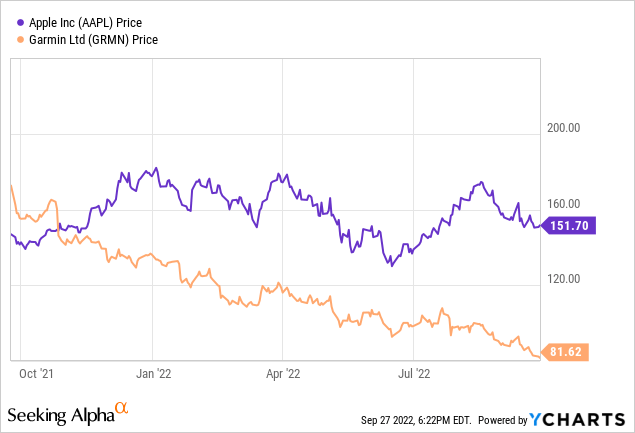

With the growing popularity of the Apple Watch among iPhone users and Apple’s improvements in fitness and the outdoors, I wonder if Garmin Ltd. (GRMN), another leader in GPS-enabled watches, could be an acquisition target. As someone who loves fitness and the outdoors and is a longtime Garmin user, this seems like a natural fit. With a current market capitalization of just under $16 billion (watches make up about 60% of the business or $9.6 billion), this would be one of Apple’s largest acquisitions. With Garmin down nearly 40% in 2022, it may be time for Apple to acquire another smartwatch leader and bring a leading fitness app, Garmin Connect, under its own. range of products. The acquisition would be immediately accretive to Apple, adding nearly $3 billion to revenue and $900 million to net income annually.

While this isn’t an acquisition target for Apple, I’m a bit skeptical of Garmin’s long-term prospects. Apple Watch continues to grow in popularity among iPhone users, and with Apple now targeting the fitness and outdoor community, I think investors have reason to be cautious on Garmin. For Garmin, is this a reason to get angry or scared? Time will tell us.

Targeted advertising

As a runner, I’ve been a happy user of Garmin products for 10 years, having owned the Forerunner 110 series watch (twice) and most recently the Forerunner 245 Music (currently on my wrist). I’ve also been a shareholder of Garmin in the past and I think it’s a healthy company with strong fundamentals and cash flow, but I think the growth is waning a bit so I’m currently not not a shareholder.

Previously, I had considered and dismissed the threat Apple Watch posed to Garmin. Indeed, Apple doesn’t seem to be making a concerted effort for fitness and outdoor enthusiasts. Or at least I have never been the target of such advertisements. However, on a trip to Destin, Florida last week, I saw this ad and it changed my mind.

Apple Watch advertisement (YouTube)

With a focused eye on the fitness segment, incredibly deep pockets, and tech capabilities, I wonder if Garmin should be scared or excited. I have to believe that if Apple has decided to become the smartwatch leader in the GPS fitness tracking space, it’s up to them.

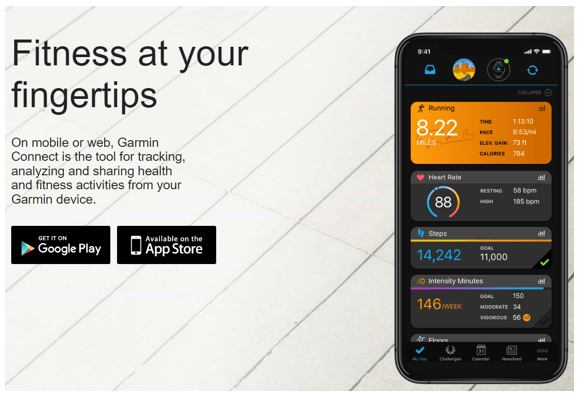

Garmin has a better fitness platform

One of the reasons I think Apple should consider an acquisition of Garmin is for the platform itself, Garmin Connect. I’ve read many customer reviews using Apple Watch for fitness tracking, and Apple’s Health app is inferior to Garmin Connect. It’s possible to connect Apple Watch to other fitness apps like Runkeeper, MyFitnessPal, and even Garmin Connect, but having a top-tier platform seems like a low-hanging fruit for Apple. I think Apple could attract a lot of new users, myself included, to the Apple Watch by having a first-class fitness tracking app. Maybe Garmin is a “buy it, don’t build it” option for Apple.

Note – Apple Watch does not sync seamlessly with Garmin Connect (i.e. it’s not one of the options to select when trying to pair devices), but there is a workaround workaround from what I’ve read, although I haven’t tried it personally.

Garmin Connect (Garmin.com)

Customer conversion

Personally, I’m considering switching to an Apple Watch as a fitness tracker because the watch offers many features that my Garmin watch does not, such as texting, phone conversations, music playback via the top -speaker, etc. Now Garmin has watches that offer additional functionality and cellular service, but these features are limited (and expensive) and cellular coverage is primarily used for emergency track and locate services only, not for personal use. routine/occasional.

However, the main factor preventing me from switching to Apple Watch is Garmin Connect because it’s just a good product. It syncs seamlessly with my watch, offers a ton of data and analytics, and has a good online community. Obviously, if Apple were to acquire Garmin, the customers would go with it, but if Apple were to develop a similar top-tier fitness app, I think a ton of existing Garmin customers would convert. I’m probably one of them, and I bet there are plenty of others sitting on the fence just like me.

What is the opportunity?

This article is from 2020, but it says that Garmin uses around 20 million watches while Apple has sold over 50 million watches since the launch of Apple Watch in 2015. If Apple were to acquire and/or convert those 20 million from Garmin users to Apple Watch users, that’s a 40% increase in the number of customers. Not too bad.

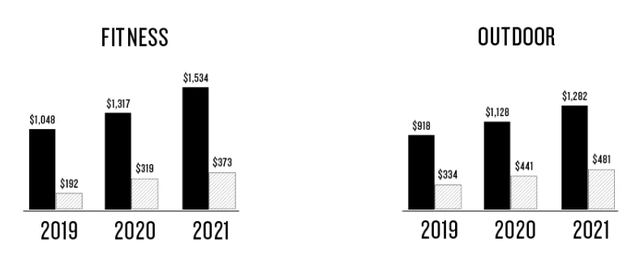

Garmin reports earnings in five segments: Fitness, Outdoor, Auto, Aviation and Marine. Garmin watches are reported under Fitness and Outdoor, which accounted for 57% of total revenue in 2021. Total Fitness and Outdoor revenue was $2.8 billion in 2021, while the operating profit was $854 million.

Turnover and operation. GRMN Revenues in billions (GRMN IR website)

There are two ways to look at this opportunity if you are Apple: as an acquirer or as a converter.

Acquirer

If Apple were to acquire Garmin, you can consider the numbers above as immediately accretive to Apple’s top and bottom bottom line. You can also assume that, through an acquisition, Apple isn’t necessarily looking to convert existing Garmin users to Apple Watch. To me, Apple’s acquisition of Garmin shows that they are more interested in minimizing competition than converting users to Apple Watch. Not that Apple can’t choose to convert Garmin users to Apple Watch, but why spend time doing it if you just bought out the competition?

From an acquirer’s perspective, Apple would benefit from an approximate $3 billion addition to revenue and $900 million to net income. Given that Apple Watch revenues are between $12 billion and $15 billion per year, acquiring Garmin would immediately boost sales by +20%.

Again, Fitness and Outdoor make up around 60% of Garmin’s business, so Apple could only acquire that specific part or bid for the whole company. Assuming Garmin was okay with only selling the Fitness and Outdoor segments, 3x sales or $9 billion seems like a steal with a 30% operating margin ($854 million / $2.8 billion). dollars). The business would probably pay for itself in 5 to 7 years.

Converter

If Apple were to cannibalize Garmin’s sales without acquiring the company, the opportunity would appear that it would offer higher revenues and profits. Indeed, the Apple Watch’s average price is higher than Garmin’s and operating margins are likely similar at +30%.

If I assume that Apple were to convert 80% of Garmin’s 20 million users to Apple Watch and the average price of watches is $500, that’s $8 billion in revenue and $2.4 billion in profit operating. However, I find it hard to believe that Apple can convert so many customers in such a short time. Customer conversions are more likely to annualize slowly over time compared to direct acquisition. The increase in sales and revenue from sales cannibalization is less appealing when you look at it in this light.

Personally, I’m not a fan of the idea that Apple could put Garmin out of business or significantly hamper sales and revenue, but it can’t be ruled out.

Conclusion

Apple and Garmin are leaders and competitors in the smartwatch industry and with Apple having a long history of acquisitions, one can’t help but wonder if Garmin might be in their sights. Apple offers a superior product in the Apple Watch, but Garmin offers a superior product with Garmin Connect. A merger of the two seems like a natural fit and would likely result in many Garmin watch users switching to Apple Watch.

Assuming an acquisition isn’t in the cards, Garmin investors should consider Apple’s impact on Garmin’s business over the long term. With Apple now targeting fitness and outdoor enthusiasts, I’d fear their deep pockets and technological expertise could cannibalize Garmin’s sales and profits over time.

No one knows if Apple is interested in such an acquisition, but I hope readers enjoyed exploring Garmin’s idea.